- 1) analysis of the environment - considered the initial stage of the strategic management process, as it provides the basis for defining the mission and goals of the organization and strategy. External environment - a set of variables, threats and opportunities outside the enterprise and not amenable to short-term control by management. The internal environment is a set of variables (strengths and weaknesses) that are within the organization and can be controlled by management over the short term.

- 2) strategy formation - definition of mission and goals (long-term and short-term). Strategy formation is the process of defining the mission and goals of an organization, as well as choosing a strategy to achieve these goals.

- 3) implementation of the strategy - the process in which the strategy is transformed into actions based on the developed programs, budgets and procedures, and also it is the process of carrying out strategic changes in the organization, translating it into a state in which the organization will be ready to implement the strategy.

- 4) assessment and control of the implementation of the strategy - provides a stable feedback between the implementation of the strategy and the goals of the organization. Strategic control is aimed at finding out to what extent the implementation of the strategy leads to the achievement of the goals of the firm.

Currently, scientists distinguish five main stages of strategic management:

- 1. Determination of the scope and development of the mission of the organization.

- 2. Development of long-term and short-term goals of the organization.

- 3. Development of a strategy for achieving the goals of the activity.

- 4. Implementation of the organization's strategy.

- 5. Evaluation of the effectiveness of the strategy based on the results of the organization's activities and the introduction of corrective actions.

Since the conditions of modern business are extremely dynamic, this process is continuous and is a constantly renewing cycle with intense feedback. In addition, the boundaries between the phases of the cycle are rather arbitrary. Thus, the formulation of specific strategic objectives undoubtedly benefits from the presence of a conceptual vision of business prospects. On the other hand, goal-setting and the choice of strategy, in turn, stimulate the further development of conceptual ideas (about the place of the firm in business, the main directions of its activities, fundamental attitudes, standards of behavior, etc.). Practical experience in implementing a strategic plan can radically change all components of the latter (both the general concept, and the intended goals, and the chosen strategies).

Let's consider each stage of strategic management in more detail.

First stage. Determining the scope of the organization involves:

determination of the satisfied need;

consumer identification;

determining the way to meet the needs of specific consumers.

That is, it is necessary to answer the question: "What, for whom and how do we produce?"

For example, Polaroid defined its business as "Developing and promoting fast photography to meet the needs of wealthy families for love, friendship, fond memories and humor." McDonald's did it this way: "Providing hot delicious food in a clean restaurant for a reasonable fee."

The mission of the organization is the verbally expressed basic socially significant functional purpose (role) of the organization in the long term (in addition to making a profit), reflecting the purpose of the business, its philosophy. This term literally means "responsible task, role".

A mission statement helps define what the business is actually doing, while focusing on the consumer rather than the product. Therefore, defining a mission involves answering the question: "What benefits can a firm bring to consumers, while achieving greater market success?"

It is believed that the mission statement should be bright, laconic, dynamic, easy to read (often a slogan).

Examples of missions:

"Two centuries of traditions - a guarantee of quality" (Foil Rolling Plant, St. Petersburg).

"We save your time and money" (Inkombank). "The elements are not subject to" (Oneximbank).

The mission of the business is of great importance for communication within the enterprise (it allows employees of the company to better understand its activities, and managers - to have long-term reference points) and outside it (helps to bring information to shareholders, consumers and suppliers).

Second phase. Determining the long-term and short-term goals of the organization

After the mission is formulated, it is necessary to determine the long-term (3 - 5 years or more) and short-term (1 - 2 years) goals of the organization.

There are eight key areas within which the company defines its goals.

- 1. Market position. Market goals can be gaining leadership in a certain market segment, increasing the market share of an enterprise to a certain size.

- 2. Innovation. Targets in this area are associated with the definition of new ways of business trends: the organization of the production of new goods, the development of new markets, the use of new technologies or methods of organizing production.

- 3. Performance. More efficient is the enterprise that spends less economic resources on the production of a certain amount of products.

- 4. Resources. The need for all types of resources is determined.

- 5. Profitability. These goals can be expressed quantitatively: to achieve a certain level of profit, profitability.

- 6. Management aspects. Ensuring profit in the long term is possible only through the organization of effective management.

- 7. Personnel. Personnel goals can be related to the preservation of jobs, ensuring an acceptable level of remuneration, improving working conditions and motivation, etc.

- 8. Social responsibility. Most Western economists now recognize that firms should focus not only on increasing profits, but also on developing shared values.

The objectives of the enterprise must meet the following characteristics:

- 1. Objectives must be specific and measurable.

- 2. Objectives should have a specific planning horizon, that is, determine when results should be achieved.

- 3. The goal must be achievable.

- 4. The goals should be flexible and have room for adjusting them in connection with unforeseen changes in the external environment and internal capabilities of the enterprise. This ensures that the goals are realizable.

- 5. The multiple goals of the enterprise should be comparable and mutually supportive.

An example of a long-term goal of a transport company: "To become the largest and best transport company in the world"; General Electric: "To become the most competitive company in the world and rank first and second in all areas of business where the company operates."

Short-term goals are formulated according to the same principles as long-term goals, but they are more specific and presuppose prompt actions in a short period of 1-2 years, aimed in aggregate at achieving a long-term goal.

Stage three. Formulating a strategy

Strategy formulation is a management function that consists in shaping the organization's mission, defining performance goals and creating a strategy. The end product of strategy formulation is a strategic plan.

Strategic plan - a document containing the purpose of the organization, its directions of development, long-term and short-term objectives and development strategy.

A strategy is necessary both for the entire company as a whole and for its individual connecting links - research, sales, marketing, finance, labor resources, etc.

When forming a strategy from many feasible options, the manager, acting as an indicator, seeks new opportunities and is a kind of synthesizer of different trends and approaches taken at different times and in different divisions of the company.

The organization's strategy is constantly evolving. There is always something new to react to, and as a result, new strategic niches are opening up. Therefore, the task of improving the strategy is endless.

The company's strategy must always combine the planned line of behavior and the ability to respond quickly to everything new.

Fourth and fifth stages. Implementation of the strategy, assessment of its effectiveness and adjustment of the previous stages

The last two stages are considered together, since they do not have clear distinctions. In the process of implementing the strategy, it is constantly being evaluated and adjusted.

Strategy implementation is not only a function of top management, but a job for the entire management team. All managers act as implementers of the strategy within the framework of their authority and responsibility.

The last stage is a bridge that returns the company to its original first points, but at a qualitatively new level.

Thus, the strategic management process can be represented as a continuous upward spiral.

Components of strategic management. Strategic enterprise management includes five main components that form the following chain of long-term-target decisions (Fig. 1).

- Vision is an image of the possible and desired future state of the enterprise.

- Business area - a type of activity associated with a specific business unit, program, etc. Defining a business involves assessing its prospects and understanding its specific place and opportunities in it.

- The mission, or socially significant role, of the enterprise is a qualitatively expressed set of the main goals of the business.

Rice. 1. The chain of promising-target decisions in the management of enterprise development

- Strategy is an integrated model of actions designed to achieve the goals of the enterprise. The content of the strategy is a set of decision-making rules used to determine the main directions of activity.

- Programs and plans are a system of measures for the implementation of the strategy adopted by the enterprise, designed to solve the problems of allocating resources, powers and responsibilities among the units (employees) involved in the implementation of the strategy; development of operational plans and programs.

Stages of strategic management... The main stages of strategic management are:

- analysis of the environment;

- defining the mission and goals of the organization;

- formation and choice of strategy;

- implementation of the strategy;

- evaluation and control of the strategy implementation.

Analysis of the environment is the initial process in strategic management, as it creates the basis for defining the mission and goals of the organization, working out a strategy for its development. The internal environment of the organization is analyzed in the following areas: marketing, finance and accounting, production, personnel, management organization. When analyzing the external environment, economic, political, social, international factors, as well as factors of competition are investigated. In this case, the external environment is divided into two components: the immediate environment (environment of direct impact) and macroenvironment (environment of indirect impact). The purpose of strategic analysis is to identify threats and opportunities in the external environment, as well as the strengths and weaknesses of the organization (this is the so-called SWOT analysis).

The mission and goals definition process consists of three sub-processes:

- the formulation of the mission of the organization, which in a concrete form expresses the meaning of its existence;

- defining long-term goals;

- definition of medium-term goals.

The formulation and choice of a strategy involves the formation of alternative directions for the development of the organization, their assessment and selection of the best strategic alternative for implementation. At the same time, a special toolkit is used, including quantitative forecasting methods, the development of scenarios for future development, and portfolio analysis.

The implementation of the strategy is a critical process, since it is he who, if successfully implemented, leads the company to achieve its goals. The implementation of the strategy is carried out through the development of programs, budgets and procedures, which can be considered as medium and short-term plans for the implementation of the strategy. The main components of the successful implementation of the strategy:

- The goals of the strategy and plans are communicated to employees in order to achieve on their part an understanding of what the organization is striving for and to involve them in the process of implementing the strategy.

- the management ensures the receipt of all the resources necessary for the implementation of the strategy in a timely manner, forms a plan for the implementation of the strategy in the form of targets;

- in the process of implementing the strategy, each level of management solves its own tasks and carries out the functions assigned to it.

The results of the implementation of the strategy are assessed, and with the help of a feedback system, the activities of the organization are monitored, during which the previous stages can be adjusted.

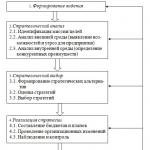

The sequence of interrelated works on strategic analysis, selection and implementation of a strategy is the process of strategic management (Fig. 2).

Rice. 2. Model of the strategic management process

As you can see from the diagram, the process of developing a strategy is iterative (cyclical). So, the definition and selection of a strategy can occur at the stage of analyzing the external environment, and the assessment of the strategy will require additional external analysis. In addition, a change in strategy leads to the need to monitor and annually adjust strategic decisions and plans.

Stages of strategic management:

Analysis of the environment;

Strategy formation;

Strategy implementation;

Assessment and control of strategy implementation.

Analysis of the environment is considered the starting point of the strategic management process as it provides the basis for defining the mission and objectives of the organization and formulating the strategy. External environment - a set of variables, threats and opportunities outside the enterprise and not amenable to short-term control by management. The internal environment is a set of variables (strengths and weaknesses) that are within the organization and can be controlled by management over the short term.

Strategy formation - definition of mission and goals (long-term and short-term). Strategy formation is the process of defining the mission and goals of an organization, as well as choosing a strategy to achieve these goals.

Strategy implementation is the process in which strategy is translated into action based on developed programs, budgets and procedures, and it is also the process of making strategic changes in the organization, translating it into a state in which the organization will be ready to implement the strategy.

Evaluation and control of strategy implementation - provides sustainable feedback between the implementation of the strategy and the goals of the organization. Strategic control is aimed at finding out to what extent the implementation of the strategy leads to the achievement of the goals of the firm.

Requirements for a strategic manager

In today's complex and rapidly changing environment, a fundamental role is assigned to those who manage the development of strategy, i.e. strategic managers. According to E. Wrappe (University of Chicago), the most successful strategic managers should have the following qualities:

Be well informed, which provides for the possibility of making a wide range of management decisions at different levels of management. Managers must create a network of sources of information in different parts of the organization that will enable them to stay within the operational realities;

To be able to manage your time and energy, and, therefore, to effectively distribute and know when to delegate responsibility and when to get involved in private decisions;

To be good politicians, to have the art of reaching consensus on the basis of their ideas, and not "crushing" authority to promote them, to act as a member or leader of a coalition, and not as a dictator;

Should not, as experts, "get stuck". A changing world requires a certain amount of flexibility from the strategic manager. He must be ready to maneuver and adapt to the evolving situation. This does not mean that the firm should act without specific goals, but should be ready to adjust them;

Contribute to the promotion of the program in private areas.

Strategic manager tasks

A strategic manager is a person who leaves an imprint on the activities of an organization, on its main independent divisions. The main task of the strategic manager is to ensure the activities of the organization (preserving the "health" of the organization) while moving in a certain direction.

Broadly speaking, the challenge for managers is to choose the structure that best suits the goals and objectives of the organization, as well as the internal and external factors affecting it. The “best” structure is the one that best allows the organization to effectively interact with the external environment, efficiently and effectively distribute and direct the efforts of its employees and, thus, meet the needs of customers and achieve its goals with high efficiency.

Strategic managers are often referred to as complex managers. They differ from functional managers, who ensure the implementation of specific business functions (personnel, procurement, production, sales, customer service, accounting), and occupy a unique position in the company, managing the organization in a strategic sense.

Strategic management functions

Strategic management - substantiation and selection of promising goals for the development of an enterprise and increasing its competitiveness, their consolidation in long-term plans, the development of targeted programs that ensure the achievement of the intended goals. The most important, promising issues should be dealt with directly by the general director or the owner of the company, who can be helped by referents (headquarters). Otherwise, he will eventually have to give way to another person who actually performs these functions.

Strategic management involves the implementation of the following functions:

a) determining the goals of the company, taking into account the market situation;

b) determining the means to achieve these goals;

c) segmentation, that is, dividing a common goal into subgoals;

d) development of appropriate long-term plans and programs.

All types of management are interconnected. Any manager performs administrative functions, manages personnel, participates in the choice of goals for his activities and means of achieving them. The director of a small enterprise and even more so an individual entrepreneur himself performs all or most of the functions. Only with the increase in the size of the company does it become possible to assign them to different employees or management departments. However, in all cases, it is advisable to distinguish and analyze the types of management, since they are characterized by special means and methods of management, skills and techniques. Strategic management is the basis of enterprise management. Setting development goals and means of achieving them determines the objectives of all types of management.

Algorithm of the strategic management process is implemented at all three main levels of managerial decision-making, serves to describe various tasks at each level, determines the procedure for making final decisions and indicates the sequence of tasks.

The algorithm of the strategic management process consists in the development and implementation of the following stages:

- Stage 3. Determination of strategic goals.

- Stage 4. Formulation and selection of strategic alternatives.

- Stage 5. Development and approval of a business plan, assessment of the effectiveness of a strategic alternative.

- Stage 1. Bank Mission and Vision Statement.

Bank Mission Statement is the initial stage of strategy development. The Mission statement is the answer to the questions: "For what and for whom do we exist?", "What is our purpose in meeting certain needs of society?"

The bank's mission is the raison d'être of its existence. It reflects the purpose of the bank, its positioning (unlike other participants in the banking market), determines the role that the bank wants to play in society.

The choice of the Mission is determined by the potential and size of the bank. The larger the bank, the more globally the goals are set for it. For small banks, it is advisable to choose a Mission that would provide them with ample scope to operate and at the same time not lead to dissipation of efforts. When choosing a Mission, two extremes are dangerous: choosing too large-scale (difficult) or too narrow (modest mission).

The Mission statement should include:

- · The main direction of the bank's activity;

- · The main category of clients;

- · The needs of customers, satisfied by the bank;

- · A distinctive feature that emphasizes the peculiarity of the bank, allowing interested parties to distinguish it from others;

- · Sides of the bank's activities, which it is turned into the external environment, thanks to which it is clear what its public utility is.

The mission is important both for the clients of the bank and its partners - they more accurately understand what can be expected from it, and for the bank's employees, as it forms the values, beliefs and principles of the business. The mission consolidates the efforts of the staff to improve the efficiency of the organization. The Mission for internal use by employees should reflect:

- · The main intentions and goals of the bank;

- · Basic principles of the bank;

- · For whom we exist on the market and what we offer;

- · Relationships and interactions with our clients;

- · Relations with shareholders and partners;

- · Relations with the environment (controlled bodies, local authorities, public organizations, mass media).

The mission can be formulated both in the form of a single paragraph, and in the form of a section, which reflects all aspects of the bank's activities. The short version is intended for public presentation, the expanded version is intended for internal use and the development of the bank's strategy.

Unlike Mission, Vision is a perspective, an answer to the question "What does the bank want to be?" This is a detailed description of the future state of the bank, directions of activity and main strategy. It is the premise of good leadership through the implementation of coherent and interrelated strategic decisions.

Mission and Vision act as the upper level of design and a means of assessing the correctness of the choice of strategic goals and strategies at each stage of development.

Stage 2. Strategic analysis.

Under external analysis means the study of the state and dynamics of changes in conditions and factors external to the bank that are currently or in the future affecting the bank, affecting its condition, products sold, services rendered, its customers, information systems, work organization, personnel, etc.

Under internal analysis means the study of the state and dynamics of development of the bank itself - the type, volume and structure of products and services, the volume, structure and characteristics of the client base and their changes over time, the development of technologies (business processes) of the bank, improvement of bank management, innovations, promising projects, technical bank equipment, etc.

The purpose of the analysis is to determine opportunities and threats, outgoing to the external environment of the bank, as well as strengths and weaknesses of the bank, allowing to generally determine key success factors and key competencies the bank, contributing to the development of a more informed bank strategy. Let's consider these issues in more detail.

External analysis

When analyzing the external environment, it is necessary to highlight several factors that significantly affect the bank in question:

- - oil price;

- - prices for other raw materials exported from Russia;

- - exchange rates against the ruble and their change;

- - dynamics of interest rates in other countries;

- - changes in the ratings of countries and their debt obligations;

- - prices for gold, real estate and other assets.

It is necessary to highlight the main segments of the external environment that affect the bank in question are:

- 1) Social environment - demography, lifestyle, political, social, technological and economic values that affect both the bank as a whole and its customers.

- 2) Economic environment - inflation forecast; forecast of interest rates on the interbank lending market; forecast of the US dollar exchange rate, forecast of the yield on government securities, the level of production, consumption, income and savings, investment and productivity, etc.

- 3) Political environment - administrative, regulatory and legal institutions that enact and implement laws, regulations and rules in society.

- 4) Technological environment - the level and direction of technological progress or improvement, new products, services, materials, processes, achievements in fundamental science.

- 5) Ecological environment - physical and natural resources located within the regions of the bank's activity (land, sea, air, water, flora and fauna), as well as regulatory requirements for their preservation or restoration.

- 6) Institutional environment - physical infrastructure (roads, railways and waterways) and communications (post, telephones, communication systems) in terms of possible impact on the bank's leading clients.

The most important component of the analysis of the external environment is marketing analysis of the economic environment including:

- Analysis and selection of products and services in the banking market of the country, especially in the areas of operation of a particular bank under consideration - types, types, areas of improvement of banking products and services, possible new products and services, dynamics of supply and demand, analysis of tariffs and prices for products and services , cost estimate, assessment of the quality of services provided, ways to promote products and services; benchmarking, determination of competitive advantages;

- · Positioning of banking products (ensuring a competitive position in the market with banking products and services);

- Analysis of existing and potential customers of the bank - a detailed study of the needs of existing and potential customers of the bank and the development of their business, unmet needs, motivation of loyalty, profitability of existing customers, the bank's share in the market as a whole and in its individual segments, benchmarking of relationships between banks and customers and methods attracting customers, determining competitive advantages, market segmentation and searching for target market segments of a given bank;

- · Analysis of the bank's competitors (strengths and weaknesses of competitors, their goals and strategies, dynamics and results, organization and structure, current and future possible actions and threats, possible reactions to the actions of the analyzed bank); benchmarking;

- · Analysis of threats and risks of the market.

The main results of the analysis of the external environment are the definition:

- 1. key success factors;

- 2. market threats associated with serious risks for the bank.

Key success factors are the main determinants of financial and competitive market success. This is what the market expects from the bank: its reliability, perfect products and services and their dynamic promotion, excellent relationships with customers, correct relations with competitors, open relationships with control authorities and local authorities, etc.

Internal analysis

An internal analysis of the bank when developing its strategy is carried out in order to determine its strengths, competitive advantages that allow the bank to develop successfully, as well as weaknesses that hinder the development of the bank or pose a threat to it associated with the loss of customers and income.

It is advisable to start the analysis by defining a set of indicators that characterize the bank. These indicators can be similar to the Bank's Balanced Scorecard (BSC) and include:

- a) financial indicators;

- b) indicators of relationships with bank customers;

- c) indicators characterizing the business processes (work technology) of the bank;

- d) indicators of personnel qualifications.

To determine the strengths and weaknesses of the functioning of the bank, it is necessary to compare them with similar sides of other banks or conduct regular blackmarking. Beechmarking is a systematic activity aimed at finding and evaluating best business practices and learning from these examples.

An internal bank analysis should be carried out for each type of activity:

- - a system of products and services offered by the bank;

- - the structure, characteristics, dynamics of changes in the client base and the reasons for its expansion or contraction, as well as those types of bank activities that are most attractive to them;

- - the efficiency of organizing the work of banking divisions, including branches and offices;

- - information and technical equipment of the bank;

- - relationships with correspondent banks, with supervisory and local authorities;

- - organization of training and advanced training of personnel;

- - organization of bank management.

The results of internal analysis can be presented in the form of a summary table:

Table 1. Results of internal analysis

In the absence of quantitative indicators, the table is filled with qualitative assessments. The possible financial result is estimated preliminary. From this table, the competitive advantages (distinctive, core, key competencies) of the bank should be determined. Key competencies are a fusion of used technologies, professional staff and perfect management. The bank, using key competencies, using key success factors, builds an effective business strategy.

The main result of the analysis of the internal environment is to determine:

- 1.competitive advantages (distinctive, core, key competencies);

- 2. weaknesses, shortcomings of the organization associated with a serious risk to the bank.

After conducting external and internal analysis, the bank must determine:

- a) where he is now and what is his condition, expressed in the characteristics of his customers, products, services, technology, personnel and management;

- b) in the direction he wants and can develop.

SWOT analysis.

SWOT analysis ( Strengths - strength, Weaknesses - weakness, Opportunities - opportunities, Threats - threats). The analysis can use the following characteristics derived from external and internal strategic analysis.

Table 2. Indicators of SWOT analysis

|

Indicators |

Specifications |

|

Strengths - competitive advantages of the bank |

|

|

Weaknesses - weaknesses of the bank |

|

|

Opportunities are key success factors (favorable circumstances, the use of which creates an advantage for your bank) |

|

|

Threats - factors that can potentially worsen your bank's position in the market |

|

The next step is to compare the bank's strengths and weaknesses with market opportunities and threats. For this purpose, each key success factor is compared in pairs with each competitive advantage in order to determine:

- 1. how to take advantage of the opening opportunities (key factors of success), using the competitive advantages of the bank;

- 2. how the key success factors can neutralize the weaknesses (weaknesses) of the bank.

- 1. how external threats can be neutralized by the competitive advantages of the bank;

- 2. What external threats, aggravated by the bank's shortcomings, should be most feared and what measures should be taken to neutralize them or mitigate the possible consequences.

As a result of the SWOT analysis, we get a list of possible promising areas of the bank's work, which may include:

- 1. Building up the bank's equity capital.

- 2. Attracting long-term cheap funds from abroad, placing these funds in highly profitable projects of clients.

- 3. Raising funds by issuing shares and bonds.

- 4. Control over the costs of the bank and their rational reduction.

- 5. Creation of a system of permanent assessment, control and prevention of risks.

- 6. Implementation of the strategic management system by the bank - creation of an analytical department.

- 7. Development and implementation of a personnel training and motivation system.

- 8. Strengthening work to create an attractive image of the bank.

- 9. Strengthening work with plastic cards, purchase and installation of ATMs.

- 10. Opening additional branches of the bank, other structural divisions, etc.

- 3 and 4 stages. Determination of strategic goals. Formulation of strategic alternatives, selection of a strategic alternative.

The goal is the specific state of certain characteristics of the company, the achievement of which is desirable for it and the achievement of which its activities are directed.

The strategic alternatives and goals of the bank are determined after the Bank's Mission is formulated and the strategic analysis is carried out.

Goals show what the bank is striving for and what it wants to achieve in the long, medium and short term. A bank's goals are carefully scrutinized, categorized as long-term, medium-term, and short-term, and are usually presented in an ordered tree of goals. The goals must meet several prerequisites (SMART principle), they must be:

- · Specific (Specific);

- · Measurable (Measurable);

- · Agreed (Agreeable, Accordant): with the Mission of the bank, among themselves, with those who have to fulfill them;

- · Achievable (Realistic);

- · Defined in time (Timebounded).

Higher-level goals are always broader in nature and have a longer span of achievement. The goals of a lower level act as a kind of means for achieving goals of a higher level. For example, short-term goals are derived from long-term ones, are their concretization and detail, subordinate to them. Short-term goals, as it were, set milestones, milestones on the way to achieving long-term goals. The hierarchy of goals establishes the coherence of the organization and ensures the orientation of the activities of all departments to achieve the goals of the upper level.

The process of establishing a goal tree involves the following phases:

- 1. Establishment by shareholders and top managers of the main goal of the bank.

- 2. Development of strategic alternatives to achieve the main goal of the bank. Evaluation of the effectiveness of each formulated alternative. Choosing one of the strategic alternatives. The choice of one or another strategic alternative is one of the most difficult management decisions. The essence of the analysis of alternatives and the development of a company's development strategy is to help the management and management of the company solve the problem of strategic choice.

- 3. Building a tree of goals for all divisions of the bank, the achievement of which will lead to the implementation of the chosen strategic alternative.

- 4. Development of plans and programs of the bank's divisions for the implementation of the selected strategic alternative.

- 5. Setting individual goals. The hierarchy of goals should be brought up to the level of the leading specialists of the bank.

Until now, for most Russian banks, profit remains the highest goal. Moreover, the profit of each current quarter and year is important for the bank's management. At the same time, the world has long distinguished between current financial results and strategic success in the future. Increasing the bank's market strategy in the interests of shareholders is a strategic goal of the bank's corporate development strategy, its financial goal.

Stage 5. Development and approval of a business plan.

A business plan is a document that defines the goals of activities in the field of business and management and outlines the ways and means of achieving the set goals based on an analysis of all the problems that arise. According to the Directives of the Bank of Russia dated 05.07.2002 No. 1176-U "On business plans of credit institutions", which contain the basic requirements for a business plan of a credit institution and the procedure for submitting it to the Bank of Russia: "A business plan is a document for the next two calendar year, containing the proposed action program of the credit institution, including parameters (indicators) and expected performance results, and allowing the Bank of Russia to assess:

- a) the ability of the credit institution to ensure financial stability, comply with prudential standards of activity and mandatory reserve requirements, comply with the requirements of the legislation to ensure the interests of creditors and depositors;

- b) the ability of the credit institution to long-term existence as a profitable commercial organization;

- c) the adequacy of the management system of the credit institution to the risks assumed. "

The business plan is the result of research and organizational work, the purpose of which is to study a specific direction of the bank's activities in a particular market in the current organizational and economic conditions. It is not a document drawn up once and for all. It must be periodically monitored and refined (adjusted) in accordance with changing conditions. The business plan is based on the general concept of the bank's development and is one of the documents that determine the bank's development strategy. The peculiarity of a business plan as a strategic document is its balance in setting objectives, taking into account the real financial capabilities of the bank. The development of a business plan largely allows to determine the potential of the bank, set new goals and objectives, develop the most rational management decisions, coordinate the actions of divisions, identify the strengths and weaknesses of personnel and the entire credit institution.

The purpose of a business plan is to address at least four fundamental objectives:

- 1. to study the prospects for the development of the future sales market for products in order to produce what can be sold, and not sell what can be produced;

- 2. Estimate the costs that will be required to manufacture and market the products needed by this market, and compare them with the prices at which it will be possible to sell in order to determine the potential profitability of the business;

- 3. discover all kinds of "pitfalls";

- 4. to determine the criteria and indicators by which it will be possible to regularly monitor whether the business is going up or down.

The main principles of drawing up a business plan are:

- · When forming a business plan, it is necessary to take into account the real possibilities of the bank.

- · The business plan, if possible, should be formed with a mandatory positive financial result. When forming a planned loss-making result, it is necessary to submit a plan for the financial recovery of the bank.

- · The structure of assets and liabilities should be balanced, i.e. an increase in liabilities should be accompanied by an increase in assets and vice versa.

- · When forming a business plan, it is necessary to strive to increase the positive difference between the weighted average rates of placement and attraction (interest margin) by optimizing the structure of attracting and allocating resources.

The difference between the bank's business plan and strategic alternatives is that the business plan quantifies the chosen strategic alternative, checks the feasibility and effectiveness of its implementation, calculates the expected financial effect and formulates proposals for choosing one or another strategic alternative. The strategic alternative adopted by the owners and top managers of the bank is approved as the bank's strategy and further work is organized to implement it.

Stage 6. Approval and implementation of the bank's strategy.

The chosen strategy of the bank is approved at the meeting of shareholders of the bank and is confirmed by the document "Corporate strategy of the bank". In some banks, a document "Concept for the development of a bank" may be developed, in which, in addition to the consolidated strategy, the Mission and Vision of the bank are indicated.

The effectiveness of the implementation of the strategy, its usefulness for the bank is determined by the quality of its development, the role and participation of the management and owners of the bank in the process of developing the strategy.

The main stages in the process of implementing the strategy:

- 1. Training of personnel and training in the goals and objectives of the strategy, the BSC system, optimization of business processes, increasing initiative and responsibility. This phase should be planned and carried out in parallel with the development of the strategy.

- 2. Development and implementation of a system of incentives and motivation of employees in accordance with the organizational structure of the bank, the system of indicators adopted in the strategy for the assessment and planning of each division.

- 3. Operational planning and implementation or improvement of the budgeting system in the bank, taking into account the adopted system of BSC indicators. Budgeting is a technology of financial planning, accounting, control and analysis of income and expenses, assets and liabilities of a bank. Budget - a monetary directive plan for future operations, used to plan, control and evaluate the effectiveness of the organization.

- 4. Periodic adjustment of the strategy and the system of strategic indicators, taking into account changes in the external environment and the achieved results of work.

The effectiveness of the developed and implemented strategy of the bank can be assessed using a system of assessments and indicators used at the stage of strategy implementation. Various options for assessing the effectiveness of the strategic management of the bank are outlined in the second part of the work.

The strategic management process consists of several sequentially performed stages (Fig. 1)

Rice. 1. The main stages of the strategic management process

Analysis of the external and internal environment

Mission statement

Defining goals

Strategy development

Implementation of the strategy

Correction (based on plan / actual analysis)

The stages “Formulation of the mission”, “Determination of goals” and “Development of strategies” can be combined into one stage "Strategic planning" - key stage of strategic management.

Strategic planning - a set of actions and decisions taken by management that lead to the development of specific strategies designed to help the organization achieve its objectives.

Teacher comments:

The material on the mission and goals of the organization is missing here, these are separate questions for the state exam.

After the strategic goals of an enterprise or organization are formulated, the ways of achieving them are determined, that is, a strategy is developed.

Strategy - a long-term, qualitatively defined direction of the organization's development, concerning the sphere, means and forms of its activity, the system of relationships within the organization, as well as the position of the organization in the environment.

Strategy - the priority direction of the enterprise's activity, which is formed on the basis of the existing field of projects (ways of solving problems and assessing the existing potentials). ...

Distinctive features of the strategy:

one). The process of developing a strategy does not end with a specific action and the development of directions, the advancement along which ensures the growth and strengthening of the firm's position.

2). The formulated strategy should be used to develop projects using the search method. The role of the strategy is to focus on certain areas or opportunities and discard all other possibilities as incompatible with the strategy.

3). The need for this strategy disappears as soon as the course of events brings the organization to the desired development.

Strategy is the link between a mission and a specific plan. It differs from a mission in that it is focused on achieving specific goals. The construction of the plan is carried out on the basis of the formulated strategies.

Thus, the organization's strategy is developed based on the goals of the organization, taking into account the results of the analysis of the external and internal environment.

Types of strategies

1. Basic strategy- a fundamental decision for the development of the organization. That is, whether the organization will grow or reduce (curtail) its activities. Or it will fix the scale of activity at the existing level. The growth or curtailment of activities is usually measured in terms of the volume of sales of products in physical terms (and not in value).

Basic strategies reflect four different approaches to the growth of a firm and are associated with a change in the state of one or more of the following elements: product, market, industry, position of the firm within the industry, technology.

The first group of basic (reference) strategies make up the so-called strategies concentrated growth... This includes those strategies that are related to product and / or market changes and do not affect the other three elements.

strategy to strengthen market position, in which the company does everything to win the best positions with this product in the given market. This strategy requires a lot of marketing effort;

market development strategy, which consists in finding new markets for an already produced product;

product development strategy, assuming the solution of the problem of growth through the production of a new product and its implementation in the market already mastered by the company.

The second group of basic strategies. These strategies are called strategies integrated growth. Typically, a firm can resort to implementing such strategies if it is in a strong business. The firm can pursue integrated growth, both through the acquisition of property and through expansion from within. Moreover, in both cases, there is a change in the position of the firm within the industry.

There are two main types:

a strategy of reverse vertical integration aimed at the growth of the company through the acquisition or strengthening of control over suppliers, as well as through the creation of subsidiaries that carry out the supply;

a strategy of forward-going integration, which is expressed in the growth of the firm through the acquisition or already strengthening control over the structures located between the firm and the end user, that is, over the distribution and sale systems.

The third group of basic strategies Are strategies diversified growth.

These strategies are implemented in the event that firms can no longer develop in a given market with a given product within a given industry.

Strategies of this type are as follows:

a strategy of centralized diversification, based on the search and use of additional opportunities in the existing business for the production of new products (car - motorcycle);

horizontal diversification strategy... With this strategy, the firm must focus on the production of such technologically unrelated products that would use the existing capabilities of the firm, for example, in the area of supply. Since a new product should be focused on the consumer of the main product, then in terms of its qualities it should be concomitant with an already produced product (health club for subscribers);

conglomerate diversification strategy, consisting in the fact that the company expands through the production of technologically unrelated to the already produced new products that are sold in new markets. This is one of the most difficult development strategies to implement (Coca-Cola - sports equipment).

The fourth type of basic strategies business development strategies are reductions... These strategies are implemented when a firm needs to regroup its forces after a long period of growth or in connection with the need to improve efficiency, when there are recessions and dramatic changes in the economy.

There are four types:

elimination strategy, which is an extreme case of a reduction strategy and is carried out when the firm is unable to conduct further business;

harvest strategy, which involves abandoning a long-term view of the business in favor of maximizing income in the short term. This strategy is applied to a promising business that cannot be sold profitably but can generate income during the “harvest” period;

reduction strategy, which consists in the fact that a firm closes or sells one of its divisions or businesses in order to carry out a long-term change in the boundaries of doing business. Often this strategy is implemented by diversified firms when one of the industries is poorly combined with others;

2. Competitive strategy- a choice between focusing on the entire market or on a part of it, as well as between the main competitive advantage (low price of the product or its distinctive features). Competitive strategies:

Cost Leadership- the products are similar, the company is trying to reduce the price.

Differentiation strategy- Some of the qualities of the product (packaging, dimensions, after-sales service, environmental friendliness, etc.) are given a difference (of course, for the better) from competitors' products. As part of this competitive strategy, the product is targeted at all consumers.

Concentration strategy- focus on isolated market segments (to meet a specific need). It is believed that it is necessary to specialize in quality (focus differentiation).

3. Functional strategy- the choice of decision-making rules in each functional area. Thus, any organization has several functional strategies (for example, marketing strategy, financial strategy, etc.). It is desirable that they be formalized in writing in the form of policies.

In particular, the functional strategies are as follows:

Manufacturing strategy (“Produce or buy”) - defines what exactly the enterprise produces itself, and what it acquires from suppliers or partners, that is, how deeply the production chain is worked out.

Financial strategy - choice of the main source of funds: development at the expense of its own funds (depreciation, profit, issue of shares, etc.), or at the expense of borrowed funds (bank loans, bonds, commodity loans from suppliers, etc.).

Organizational strategy – decisions on the organization of work of employees (choice of the type of organizational structure, remuneration system, etc.).

Other types of functional strategies can also be distinguished, for example, a research and development (R&D) strategy, an investment strategy, etc.

In addition, each of the functional strategies can be divided into components. For example, an organizational strategy can be divided into three components:

organization building strategy - the choice of the type of structure (divisional, functional, project, etc.);

HR strategy - a way of training personnel (mainly management personnel 1), training employees (at the enterprise or in educational institutions), planning the career of employees, etc.;

remuneration strategy (in a broader sense - incentives and penalties) - in particular, the approach to remuneration of top managers (salary, bonuses, profit sharing, etc.).