Tax revenues form the bulk of budget revenues at various levels.

The tax system of the Russian Federation is a set of all taxes, fees, duties and other payments levied by state bodies of all levels in the prescribed manner throughout the country.

The essence of the tax system is the withdrawal by the state in its favor of a certain part of the gross domestic product in the form of compulsory contributions, due to which the financial resources of the state are formed, accumulated in the revenue side of the budget and off-budget funds.

Tax is a mandatory individual gratuitous payment levied by government bodies from organizations and individuals in the form of alienation belonging to them by right of ownership, economic management or operational management of funds, in order to financially support the activities of the state and municipalities.

It is necessary to distinguish taxes from fees and duties.

Fee - a compulsory fee levied from organizations and individuals, the payment of which is one of the conditions for the payment of fees by state bodies, local authorities, other authorized bodies and officials of legally significant actions, including the granting of certain rights or the issuance of permits (licenses) ...

Duty is a mandatory payment levied by state and other authorized bodies for the performance of legally significant actions against the payer. A duty is levied on those who enter into a relationship with the authorities regarding the receipt of certain services.

The object of statistical observation is the activities of tax authorities, the subject of statistical observation is tax authorities and taxpayers.

In the economy, taxes perform the following main functions:

- fiscal (in accordance with this function, taxes fulfill their main purpose - saturation of the revenue side of the budget, state revenues to meet the needs of society);

- regulatory (regulation of production and consumption);

- control (using this function, the rationality, balance of the tax system, each lever separately, is evaluated, it is checked how taxes correspond to the implementation of the goal in the current conditions).

Distinctive features of any tax are:

- individual gratuitousness;

- lack of equivalence;

- obligation;

- legality.

The payment of the tax does not give rise to the obligation of the state to reimburse the costs incurred in any form in full to a specific taxpayer. Through the implementation of public administration functions, costs are reimbursed to all taxpayers.

The participants in tax relations are:

- organizations and individuals taxpayers or payers of fees;

- organizations and individuals - tax agents;

- tax authorities (federal executive body and its territorial bodies);

- customs authorities (federal executive body and its territorial bodies).

There are several tax classifications.

Depending on the use, taxes are divided into general and special taxes. General taxes credited to the budget to cover general expenses and have no specific purpose. Special taxes introduced to finance a specific category of costs.

Depending on the nature of the withdrawal, direct and indirect taxes are distinguished. Direct taxes - taxes on property, income and capital. They are levied directly on income and capital, and the payers are the owners of income and capital. Indirect taxes are a surcharge on the price of goods and services and are paid by the buyer. The seller or manufacturer pays them.

Depending on which government body introduces taxes, and also has the right to control and clarify them, taxes are distinguished:

- federal (established by the Tax Code of the Russian Federation and obligatory for payment throughout the territory of the Russian Federation);

- regional (established by the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation and obligatory for payment in the territories of the constituent entities of the Russian Federation);

- local (established by the Tax Code of the Russian Federation and regulatory legal acts of the representative bodies of municipalities on taxes in the Russian Federation and obligatory for payment on the territory of the respective municipalities).

Special tax regimes may provide for a special procedure for determining the elements of taxation, as well as exemption from the obligation to pay certain taxes and fees.

Special tax regimes include:

- simplified taxation system (STS);

- unified tax on imputed income (UTII);

- unified agricultural tax (USHN);

- patent taxation system (PSN);

- system of taxation in the implementation of production sharing agreements.

The largest share in the composition of taxes, fees and other obligatory payments to the consolidated budget of the Russian Federation in 2015 according to table. 5.1 accounted for (23.6%), personal income tax (20.4%), corporate income tax (18.8%), value added tax (18.9%).

The elements of taxation are:

- object of taxation;

- the tax base;

- taxable period;

- tax rate;

- the procedure for calculating the tax;

- the procedure and terms for paying the tax.

The system of indicators characterizing taxation:

- indicators of the dynamics of the share of tax revenues in budget revenues;

- indicators of the structure of regional and local taxes in dynamics;

- indicators of changes in tax rates and the size of the tax base;

- the share of taxes of the consolidated budget in GDP;

- the share of taxes of the consolidated budget of the subjects of the federation in the GRP;

- the share of taxes in the taxes of the consolidated budget;

- the share of taxes in the total amount of revenues of budgets of different levels;

- the share of direct and indirect taxes in the total amount of tax revenues;

- shares of VAT and income tax in the federal budget;

- the amount of tax revenues for individual sectors and industries;

- the volume of the total tax debt to the consolidated budget;

- additionally credited amount of taxes and financial sanctions based on the results of audits by tax authorities;

- the amount of taxes and financial sanctions received, additionally calculated based on the results of inspections, etc.

Receipt of taxes, fees and other obligatory paymentsto the consolidated budget of the Russian Federation by type, billion rubles

Table 5.1

|

consolidated watered |

including |

consolidated watered |

including |

|||

|

federal |

federal |

consolidated budgets of the constituent entities of the Russian Federation |

||||

|

corporate income tax |

||||||

|

personal income tax |

||||||

|

from it value added tax on goods (work, services) sold in the territory of the Russian Federation |

||||||

|

excise taxes on excisable goods (products) produced on the territory of the Russian Federation |

||||||

|

property taxes |

||||||

|

taxes, fees and regular payments for the use of natural resources |

||||||

|

of which mineral extraction tax |

||||||

A source: http // www.gks.ru / Federal State Statistics Service, 2017.

The information base of tax statistics is formed from the reporting data of the tax authorities, which includes information on the receipt of taxes and fees in the consolidated and federal budgets and payments to state and non-budgetary funds by types of taxes and fees.

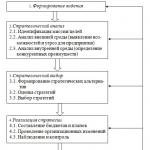

The statistical study of taxes and the tax system is carried out in the following areas:

- analysis of the tax base of taxes and fees and its dynamics depending on macro- and microeconomic trends and changes in tax policy;

- analysis of receipts of taxes and fees in the whole of the Russian Federation and the constituent entities of the Russian Federation, by the levels of the budgetary system, by types of economic activity and by groups of taxes;

- analysis of arrears and arrears of tax payments, penalties and tax sanctions, and their structure by levels of the budgetary system of the Russian Federation;

- analysis of the effectiveness of audit work and applied methods of enforced debt collection and restructuring.

One of the important areas of statistical research is the study of the dynamics and structure of tax and levy arrears. Based on the data in table. 5.2. the total amount of tax and levy arrears to the consolidated budget of the Russian Federation in 2016 increased by 3.06% compared to 2015. The arrears of regional and local taxes and levies increased significantly, by 20.3% and 21.4%, respectively. On the whole, the debt on federal taxes and duties decreased by 1.8%. The debt on taxes, fees and regular payments for the use of natural resources increased 2.9 times. The largest share (over 45%) in the structure of debt is value added tax.

Table 5.2

|

arrears |

settled indebtedness |

|||

|

Total |

||||

|

including: |

||||

|

on federal taxes and duties |

||||

|

value added tax on goods (works, services) |

||||

|

corporate income tax |

||||

|

excises on excisable goods (products) |

||||

|

taxes, fees and regular payments for the use of natural resources |

||||

|

on regional taxes and fees |

||||

|

on local taxes and duties |

||||

|

for taxes with a special tax regime |

||||

LECTURE No. 2. Government Finance Statistics

Public finance- the sphere of the country's financial system, that is, it is monetary relations regarding the distribution and redistribution of the value of the social product and its use.

A specific part of public finance is public loans, which arise in connection with the mobilization of temporarily free funds of enterprises and the population and their transfer for temporary use to public authorities to ensure financing of public expenditures.

The state attracts free funds by selling bonds and other types of government securities on the financial market. The main forms of government credit are loans and advances.

Government finance statistics keep track of general government revenues and expenditures.

Government revenues- These are financial relations associated with the formation of the finances of the state and state enterprises. The main source of the formation of government revenues is the national income.

The information base of government finance statistics was formed on the basis of:

1) reports provided by the Ministry of Finance of the Russian Federation on the execution of the consolidated, federal, territorial budget;

2) tax statistics data;

3) reports of off-budget funds.

Since 1995, a unified classification of budget revenues and a unified functional classification of budget expenditures have been used to compile reports on the use of budgets of different levels (local, federal, consolidated) in accordance with the new budget classification approved by the Ministry of Finance of the Russian Federation.

Local budgets are used to regulate local economic processes, influencing the work of local enterprises, helping to increase production, etc. An important role of local budgets is the implementation of social programs.

The budget of the territories is the main financial plan for the formation and use of the monetary fund of the region, which is approved by the highest authorities of the national-state and administrative-territorial entities of the Russian Federation.

The consolidated budget is not subject to approval and is used for calculations and analyzes.

Federal budget- This is a centralized budget, which is approved by the highest legislative bodies of the Russian Federation.

The task of government finance statistics is to develop indicators that characterize the budgetary process at each time stage:

1) drawing up;

2) consideration;

3) approval;

4) use.

There is a budget classification that includes income items (tax and non-tax) and expenses:

1) income and received official transfers;

2) expenses and crediting less repayment;

3) operations of financing the budget deficit;

4) public debt.

In the budgetary process, a business transaction is assumed (the presence of two parties - participants in the operation). From here follows the creation of the second flow to the participant of the receipt from the payment participant.

The state budget- This is the centralized monetary fund of the state, which determines the economic, social, political aspects of public life and is used to meet national needs. Budget classification is the basis for studying the state budget, which is a grouping of budget revenues and expenditures.

Revenues include mandatory non-repayable payments that go to the budget and are divided into three groups:

1) tax;

2) non-tax;

3) gratuitous transfers.

The central place in the system of state revenues is occupied by tax revenues from legal entities and individuals (value added tax, excise taxes, income taxes, income from banking and insurance activities, from operations with securities, income tax, etc.). Taxes are the main instrument for the redistribution of national income and provide government bodies with the necessary sources of funds, as well as regulate the incomes of different social groups of the population. Individuals below the poverty line are exempted from taxes. Tax revenues are the ultimate source of most budget expenditures. Accordingly, lower incomes lead to budget deficits, and low incomes can play a negative role in attracting investment.

Non-tax revenues are an integral part of government revenues and they include rather heterogeneous payments, the receipt of which by the budget has different reasons, but they are united by the fact that they are not taxes.

The RF Budget Code determines the composition of non-tax revenues, which include:

1) income from the use of property in state or municipal ownership, after payment of taxes and fees;

2) income from paid services provided by budgetary institutions under the jurisdiction of federal executive bodies, executive bodies of the constituent entities of the Russian Federation, local government bodies, after taxes and fees;

3) funds received as a result of the application of measures of civil, administrative and criminal liability, including fines, confiscations, compensations and other amounts of compulsory seizure;

4) other non-tax income.

Capital income includes income from the sale of fixed assets, government stocks and reserves, land, earmarked transfers for the construction of buildings and structures for budgetary organizations and institutions, for the purchase of equipment.

Free and non-refundable transfers include transfers in the form:

1) financial assistance from budgets of other levels in the form of grants and subsidies;

2) subventions from the Federal Compensation Fund and (or) from regional compensation funds;

3) subventions from local budgets to budgets of other levels;

4) other gratuitous and non-refundable transfers between the budgets of the budgetary system of the Russian Federation;

5) gratuitous and non-refundable transfers from the budgets of state and (or) territorial state extra-budgetary funds;

6) gratuitous and non-refundable transfers from individuals and legal entities, international organizations and foreign governments, including voluntary donations.

Expenses include all non-refundable payments, regardless of whether they are reimbursable (in exchange for something) or gratuitous and for what purposes (current or capital). The dynamics of expenditures is analyzed in areas for the national economy, socio-cultural needs, management, defense, etc.

Budget deficit- This is a financial phenomenon, when budget expenditures exceed its revenues, which does not necessarily belong to the category of extraordinary phenomena.

Government loans are used to cover budget deficits and to provide investment in the public sector of the economy. Another way to mobilize funds for government revenues is emission: paper money and credit. The government resorts to emission when taxes and loans have not provided coverage of government spending. If paper money and credit issues are not associated with the needs of the national economy, but are conditioned by the need to cover the deficit, then such emissions lead to increased inflation.

Budget surplus Is the excess of budget revenues over its expenditures.

The approved federal budget for 2007 shows that the federal budget expenditures for 2007 are determined in the amount of 5,463,479,900.0 thousand rubles. (this is 23% more than in 2006). Incomes to the revenue side of the budget are assumed in the amount of 6,965,317,200.0 thousand rubles. (which exceeds the last year's figure by 13%). The main parameters of the 2007 budget were calculated on the basis of the forecasted volume of gross domestic product in the amount of 31,220 billion rubles. and the inflation rate (consumer prices) 6.5–8.0% (December 2007 to December 2006). Hence it follows that the federal budget surplus in 2007 was planned in the amount of 1 501 837 300.0 thousand rubles. The social orientation of the 2007 budget expenditures is its characteristic feature, that is, the Federal Fund has increased by more than 35% and amounts to 35,461,321.0 thousand rubles. For the first time, the federal budget includes funds aimed at implementing a set of measures to improve the demographic situation in Russia. It is worth paying attention to the projected decrease in the upper limit of the state external debt of the Russian Federation from 79.2 billion US dollars (or 64.4 billion euros) to 46.7 billion US dollars (or 36.3 billion euros).

The statistical study of income and expenditure of the state budget is based on the series of dynamics with the calculation of the relative values of dynamics, intensity, structure, as well as the role and value of each of the main sources of income or directions of expenditure in the entire volume of the budget. Due to the fact that taxes are the most important link in financial policy in modern conditions, the analysis of their dynamics requires identifying the influence of individual factors on the change in the total amount of each type of tax.

These factors include:

1) the number of taxpayers ( ni);

2) the volume of the taxable indicator per one taxpayer ( Si);

3) the tax rate ( Ki).

The product of the levels of the three named factors gives the amount of tax paid ( U i):

U i = ni? Si? Ki.

The amount of tax received is a three-factor multiplicative model; an index method of analysis is used to assess the impact of each factor. If there is no data on the number of taxpayers, the amount of tax received can be presented in the form of a two-factor model, where the factors are the amount of taxable income and the tax rate. In order to assess how closely interconnected the total amount of the budget and individual types of expenditures, as well as the value of national income and the amount of income for individual items, you can use the empirical coefficients of elasticity.

The information source is reporting on budget execution.

The most important factor in the country's sustainable economic growth is its effective budgetary system, since budget funds finance investment programs in the field of economics, science, education, health care, etc. In this regard, it is necessary to constantly conduct financial monitoring of the budgetary system of the Russian Federation.

The results of the analysis of the current state and development trends of the budgetary system of Russia, carried out on the basis of statistical data, indicate the following:

1) a significant part of the country's financial resources is collected in the budgetary system of the Russian Federation. The revenues of the consolidated budget of Russia together with the revenues of extra-budgetary funds in 2005 amounted to 9421 billion rubles, or 43.6% of the gross domestic product (GDP);

2) financial resources, concentrating in the budgetary system of the Russian Federation, tend to increase. For the period from 1996 to 2005 the revenues of the RF consolidated budget increased from 558.5 to 7611.6 billion rubles, or from 27.8 to 35.2% of GDP. The revenues of extra-budgetary funds increased from 159.6 to 1810.1 billion rubles, or from 7.9 to 8.4% of GDP;

3) in the period from 1998 to 2005. the strongest centralization of budgetary funds took place at the federal level of the Russian Federation. If in 1998 the federal budget of the Russian Federation collected 47% of the revenues of the country's consolidated budget - 686.8 billion rubles, in 2002 this figure was 51%, then in 2003 it increased to 62%. The federal budget revenues in 2005 amounted to 4979.8 billion rubles, or 65.4% of the consolidated budget of the Russian Federation. In 2006 (according to data for January-April), their share in the consolidated budget increased to 69.4%. At the federal level in 2005, 85% of the revenues of extra-budgetary funds were generated;

4) the peculiarity of the Russian budget system consists in the excess of expenditures of the budgets of the regional (subfederal) level over their revenues and the excess of federal budget revenues over its expenditures. This phenomenon contradicts global practice, since in most countries of the world (with the exception of Finland) federal budgets are formed with a deficit, and regional budget revenues are equal to or exceed their expenditures.

The analysis shows that the budgetary system of the Russian Federation is distinguished by the concentration of financial resources at the federal level with a constant shortage of funds from sub-federal budgets.

Since in recent years there has been a decrease in the revenues of local budgets, this happened in connection with the adoption of Part II of the Tax Code of the Russian Federation (Tax Code of the Russian Federation), which abolished the main local tax for municipalities on the maintenance of housing stock and social and cultural facilities, introduced a flat scale of income tax, centralized all VAT in the federal budget, abolished sales tax. At the same time, the Budget Code of the Russian Federation (BC RF) defined the principle of independence of budgets, as well as the principle of their balance, that is, the minimum necessary expenditures provided for in the budget should be provided with income, and with a deficit permissible by law, there should be a source to cover it. Local self-government bodies in the current conditions were made completely dependent on the decisions of federal and regional authorities and deductions from taxes, grants and subventions that they receive from above. Local taxes and fees were to become the basis for the independence of local budgets. However, their list, in accordance with Art. 15 of the Tax Code of the Russian Federation, was limited to five taxes and fees: land tax, tax on property of individuals, tax on advertising, inheritance or donation, and local license fees. In this regard, the most labor-intensive (in terms of collection) and low-productivity (in terms of profitability) taxes were transferred to local budgets. Significant changes have also taken place in the expenditure side of territorial budgets. After almost all social facilities were transferred to the jurisdiction of regional and local authorities, the bulk of the costs associated with the life support of the population began to be financed from the territorial budgets, and the burden on them increased sharply. That is, national expenditures on social and cultural events are financed from territorial budgets by 82%, of which regional - by 25%, local - 57%. Based on the current circumstances, the growth rates of expenditures of territorial budgets began to significantly outstrip the growth rates of revenues. This led to an increase in the imbalance between the financial obligations imposed on the territorial budgets and the real possibilities for their implementation, and the main problem of the territorial authorities was the provision of the current expenditures of social facilities, and the financing of capital expenditures went by the wayside.

In eliminating the imbalances in the budgetary system at the subfederal and local levels, the reform of interbudgetary relations carried out in recent years, which is aimed at improving the management of public finances based on the principle of optimal decentralization of the functions of managing budget funds, is called upon to play an important role.

Since 2005, the main innovations of the introduced system of interbudgetary relations are as follows:

1) in accordance with the reform of local self-government, two levels (types) of local budgets are introduced, i.e., the budgetary system of the Russian Federation becomes four-level;

2) clear rules are introduced for delineating expenditure obligations according to the levels of the budgetary system of the Russian Federation;

3) a certain expansion of the tax autonomy of subnational authorities is envisaged;

4) the consolidation of the norms for deductions from federal taxes to the budgets of the constituent entities of the Russian Federation is established by the Budget Code of the Russian Federation, and not by annual laws on the budget;

5) new forms and principles of distribution of interbudgetary transfers are introduced;

6) the legislation establishes unified principles of building interbudgetary relations in the constituent entities of the Russian Federation while ensuring the independence of regional authorities in their specific implementation.

The prerequisites for reforming the budgetary process appeared after the division of the levels of the budgetary system. The essence of these transformations, according to the Concept of reforming the budgetary process in the Russian Federation in 2004-2006, consists in the transition from current to medium-term (for a period of at least 3 years) financial planning with a significant expansion of the powers of the "line" ministries and their reorientation from "development" annually allocated, as a rule, on the basis of indexation of costs for achieving specific and measurable results.

According to results-based planning, the most significant innovation is the separate planning of existing and existing commitments. In this case, the emphasis is on the commitments made, which include programs, resources for which are formed in two directions:

1) by increasing budget revenues in real terms;

2) with a reduction in the budget of existing obligations.

In the near future, it is planned that gradually all budget obligations will be formed as programmatic ones.

Despite the relevance and importance of measures to reform interbudgetary relations and the budgetary process, it should be taken into account that they do not really touch upon two main problems associated with the country's economic development at the subfederal level:

1) formation of investment obligations;

2) determination of the sources of their financing in the new conditions in accordance with the requirements of budgetary reforms.

Insufficient attention of the authorities to the problems of formation and targeted use of public investment resources leads to imbalances that are sustainable, the main ones include the following:

1) with a significant concentration of the country's financial resources in the budget system (43.6% of GDP), 7.5% of the consolidated budget funds were spent for investment purposes in 2005;

2) in investing the country's economy at the expense of budgetary funds, funds from subfederal budgets prevail. That is, while the consolidated budget funds are concentrated at the federal level in the amount of 69.4% and extra-budgetary funds in the amount of 85%, 2.5% of the consolidated budget funds were allocated from the federal subjects in 2005 to investments in the country's economy, and from subjects of the subfederal level - 5%, that is, twice as many. When there is a federal budget surplus of 7.7% of GDP, the low share of budgetary funds allocated to investing in the national economy indicates insufficiently effective budgetary policy of the state. Drawing a conclusion from the analysis of the budgetary system of the Russian Federation, it should be noted that, despite the ongoing budgetary reforms, the following main imbalances are inherent in it:

1) a significant concentration of the country's financial resources in the budget system (2005 - 43.6% of GDP), which negatively affects the scale of the domestic financial market;

2) excessive concentration of budgetary funds at the federal level (69.4% in the consolidated budget revenues and 85% in the revenues of extra-budgetary funds);

3) excessive surplus of the federal budget (2005 - 7.7% of GDP) with a simultaneous deficit of sub-federal budgets;

4) insufficient active use of federal budget funds for investment purposes (in 2005 - half as much as at the subfederal level).

All this means that the modern budgetary system of the Russian Federation needs further improvement in order to ensure sustainable, dynamic and balanced development of the economy. It is necessary to especially consider the problem of creating a special mechanism that allows the formation and redistribution of investment resources centralized at the federal level both to the sub-federal level and to other sectors of the economy.

Under the current conditions, one of the considered options for solving this problem may be the creation at the federal level of a budget investment fund, distributed among the constituent entities of the Russian Federation for the purpose of budgetary support for their economic development. An investment fund can be formed from two sources:

1) federal budget funds (for example, funds from the Stabilization Fund);

2) funds raised by the Government of the Russian Federation through the issue and placement of government investment securities (bonds) of a long-term nature.

A more preferable source for the formation of an investment fund is the use of the stabilization fund, since it does not require the cost of attracting resources, and, therefore, the placement of this fund among the constituent entities of the Russian Federation can be carried out with a zero or very low interest rate. Although it is hardly worth counting on the implementation of this source in the near future, since the reason for this is the other goal of creating the Stabilization Fund and the rather cautious policy of the Government of the Russian Federation in relation to the use of its funds. Taking this into account, the most possible source for creating a budget investment fund is the issue of government securities. The main direction of its use is the financing of sub-federal programs for the development of administrative-territorial entities.

In order to reform interbudgetary relations, the Government of the Russian Federation not only develops and approves strategic documents in the form of relevant concepts, strategies and programs, but also ensures their implementation by financing individual events. As part of the reform of interbudgetary relations, one of such measures may be to strengthen the revenues of subnational budgets through the implementation of the so-called Development Program. According to these goals, the Government of the Russian Federation forms an investment fund from revenues from the issue and placement of government bonds in the amount and terms corresponding to the tasks of development and strengthening of subnational budgets. As the constituent entities of the Russian Federation prepare for participation in the Development Program, it is allowed to place bonds in tranches. Bonds are placed both in the domestic and foreign financial markets, which complies with the current legislation.

The resources raised from the placement of investment bonds are sent by the Government of the Russian Federation to the constituent entities of the Russian Federation for the implementation of their investment strategy. Resources should be allocated in accordance with the territorial quota. A territorial quota is formed based on the application of a constituent entity of the Russian Federation, sent to the higher budget, to which a business plan for the use of these funds must be attached. The business plan should contain information not only about the purposes and directions of using the investment fund's funds, but also the sources of financing for the development of the territory from the private sector, a description of the work experience in this area, as well as the calculation of all performance indicators, including an increase in the budget revenues.

It is recommended that the resources allocated to the constituent entity of the Russian Federation have the character of long-term targeted government loans, which allows, on the one hand, to receive income from the budgetary funds of the federal investment fund, and on the other hand, provides a more thorough approach to the development of a business plan on the part of the constituent entity of the Russian Federation ...

The rate of return on investment bonds should be low, due to the fact that they will have the character of government securities. In 2004-2005, based on the experience of placing government bonds, the estimated yield on federal loan bonds, which are of a long-term nature, should be at the level of 1/2 of the refinancing rate. Investment resources to the constituent entities of the Russian Federation should be provided at a rate equal to 1/2 of the refinancing rate + 1% per annum, taking into account the margin covering the costs of the Government of the Russian Federation and constituent entities of the Russian Federation for the implementation of this project. The insignificant spread is explained by the fact that the Development Program will involve the constituent entities of the Russian Federation, whose business plans will be characterized by positive cash flows, their value significantly exceeds the amount of payments to the federal budget.

An investment fund formed by a constituent entity of the Russian Federation should be used not for state lending of investment projects, but to compensate for part of the interest rate on loans issued to business entities by commercial banks. This form of budgetary support for investment activities is by far the most effective. Studies show that when the regional budget development fund is used to compensate part of the interest rate for loans received by enterprises instead of direct lending to borrowers, the investment base increases by about 17 times. If we use the current refinancing rate in the country of 12%, then the amount of compensation for the interest rate in the amount of 0.5 of the refinancing rate will allow 1 ruble. funds of the investment fund to compensate for the interest rate for 16.7 rubles. private investment (16.7 rubles = 1 rubles / 0.06, where 0.06 = 0.12? 0.5). If refinancing rates are reduced, then the amount of private investment attracted increases, i.e., for example, if the rate is reduced to 10%, it will be possible to increase the attraction of private investment by 1 ruble. budgetary funds up to 20 rubles. (1 / 0.05 = 20).

The experience of the Moscow government confirms the effectiveness of the use of budgetary funds in this direction. That is, at the end of 2000 on bank loans, the amount of interest payments from the Moscow budget amounted to about 87 million rubles, the volume of attracted credit resources - about 2 billion rubles, and additional taxes of enterprises increased by 979 million rubles. in comparison with the planned indicators, i.e., by 979.0 / 87.0 = 11.3. It follows that each ruble of budgetary funds from the investment fund provides 11.3 rubles. additional tax revenues.

The use of the funds of the investment fund in full will allow the constituent entities of the Russian Federation not only to pay interest on time and return the amount of the investment loan to the federal budget, but also to include a mechanism for self-growth of investment funds from their own sources, which are obtained from additional tax revenues. This will ultimately provide them with independent support for investment processes on their territory.

It should be noted that at present there are all prerequisites for the implementation of the proposed model of strengthening subnational budgets. At the same time, the implementation of the proposed model of interaction between the participants of the budgetary system will require from the constituent entities of the Russian Federation a different approach to the management of territorial budgets than the one that has developed. The principle of management of obligations, proclaimed in the framework of reforming interbudgetary relations, should give way to the principle of management of budgetary revenues. In other words, the subjects of budget planning will have to function like effectively operating "profit centers" of complex-structured corporations.

The activities of budget planning entities should be reoriented towards the development of strategic plans for budgetary support for investment activities, which must become an organic part of the investment strategy of a given administrative-territorial entity. The form of a business plan will have a medium-term plan for the use of funds from an investment fund, which will allow raising budget planning to a higher quality level. The proposed technology for the development of promising documents by a constituent entity of the Russian Federation will generally be carried out along the chain "ATO investment strategy - a program of budgetary support for an investment strategy - activities within a program that differentiates support for different industries or sectors of the economy." Non-functional management of ATO budget revenues, which can be assessed by the fulfillment of the target figures for the growth of budget revenues, will speak of the ineffective work of the territorial administration body.

In the current international standard on government finance statistics, state budget statistics are carried out on a cash basis.

In the SNA - on an accrual basis.

From the book Finance and Credit. Tutorial the author Polyakova Elena Valerievna3.1. The essence and composition of public finance Budgetary structure Public finance is a set of financial relations that ensure the achievement of the goals of foreign and domestic state policy. These relationships are associated with the formation of financial

the authorLECTURE No. 1. The essence and history of the emergence of state and municipal finance 1. The essence of finance Finance is a system of monetary relations generated and regulated by the state, associated with the redistribution of the value of the gross domestic product, and

From the book Public and Municipal Finance: Lecture Notes the author Maria Novikova the author Sherstneva Galina SergeevnaLECTURE No. 1. Financial statistics as a science 1. The history of the emergence of financial statistics The work of an economist of any specialty is necessarily associated with the collection, development and analysis of all kinds of digital data, which are called statistical data.

From the book Financial Statistics: Lecture Notes the author Sherstneva Galina SergeevnaLECTURE No. 3. Banking statistics Banking statistics is the basis for the formation of statistics on money circulation and credit and is the statistics of the "Finance, credit, insurance, pension provision" industry. This industry includes banking,

From the book Financial Statistics: Lecture Notes the author Sherstneva Galina SergeevnaLECTURE No. 4. Insurance statistics The Russian insurance market emerged in 1992. Since many changes have occurred since then, it has become clear today that insurance is an integral part of the economy. The modern market economy is subject to multiple risks

From the book Financial Statistics: Lecture Notes the author Sherstneva Galina SergeevnaLECTURE No. 7. Enterprise finance statistics (finance statistics of institutional units) An institutional unit is an economic entity that has a legal entity, assets and liabilities (that is, enterprises engaged in a particular

From the book Financial Statistics: Lecture Notes the author Sherstneva Galina Sergeevna From the book Financial Statistics: Lecture Notes the author Sherstneva Galina SergeevnaLECTURE No. 10. Savings statistics Savings is a part of personal income that is not used for consumption, but is saved for the purpose of saving. Represents the difference between personal income and personal consumption spending. Personal savings are generated in different ways

From the book Economic Statistics author Shcherbak IA39. The concept and objectives of government finance statistics According to Russian legislation, government finance statistics include: budget statistics (federal, federal subjects, local budgets); state off-budget funds;

the author Sherstneva Galina Sergeevna3. Finance statistics as a science When many phenomena and processes in the financial system are presented in the form of quantitative statistical indicators, they become definite and significant. Without quantitative statistical characteristics, it is impossible with complete clarity

From the book Financial Statistics the author Sherstneva Galina Sergeevna37. Financial statistics of an enterprise An institutional unit is an economic entity that has a legal entity, assets and liabilities (i.e. enterprises engaged in a certain activity).

the author Maria Novikova2. History of the emergence of state and municipal finance The emergence of financial relations is associated with the process of separation of the state treasury from the property of the monarch. Since then, the term "finance" has been used. In the Middle Ages, under this term

From the book State and Municipal Finance the author Maria Novikova3. The form of the budget system from the point of view of public finance The budget system is a set of budgets of various levels, interconnected with each other. The structure of the budgetary system is based on the form of government.

From the book General Theory of Statistics: Lecture Notes the author Konik Nina VladimirovnaLECTURE No. 1. Statistics as a science 1. Subject and method of statistics as a social science Statistics is an independent social science, which has its own subject and research methods, which arose from the needs of social life. Statistics is the science that studies

From the book Theory of Statistics: Lecture Notes the author Burkhanova Inessa ViktorovnaLECTURE No. 1. Statistics as a science 1. The origin of the term "statistics" and its meaning Currently, the term "statistics" is used in various meanings. Statistics is a social science that studies the phenomena and processes of social life, it reveals the laws

After studying this chapter, the master should

know :

- objectives and system of indicators for government finance statistics;

- the basic principles of the functioning of the international financial and banking system.

- international financial organizations and their functions;

- aggregates of money supply and their structure;

- the importance of government finance statistics for solving economic problems arising in theory and practice;

be able to:

to use the acquired knowledge in practice to solve the set economic problems, using the apparatus of mathematical analysis;

own :

Conceptual apparatus in the field of government finance statistics.

The methodology for statistical analysis of public finance aims to provide a comprehensive conceptual and accounting framework suitable for analyzing and evaluating fiscal policy and public sector performance. The public sector includes the general government and government controlled units called public corporations (organizations), the main activity of which is to conduct commercial transactions, as well as the national bank.

The Statistical Study of Public Finance covers the measurement and analysis of:

- the size of the public sector, its contribution to aggregate demand, investment and savings;

- the impact of fiscal policy on the economy, including resource use, monetary conditions, and national debt;

- tax burden;

- tariff protectionism;

- social security and pension systems;

- indicators of government net debt, net worth and contingent claims on government.

A country's government bodies include government bodies and their institutions, which are structures formed as a result of political processes and possessing legislative, judicial or executive power within a given territory. The main economic functions of government bodies are as follows:

- 1) assume obligations to provide society with goods and services on a non-market basis for their collective or individual consumption;

- 2) redistribute income and property through transfer payments.

An important feature of governments is that these activities must be financed primarily through taxes or other compulsory transfers.

Classification of revenues of the budgetary system

General government units have four main sources of income: taxes and other compulsory transfers imposed by government units; property income derived from the ownership of assets; sales of goods and services; voluntary transfers received from other units.

Income is composed of disparate elements. Accordingly, these elements are classified according to different characteristics depending on the type of income. The tax classification scheme is mainly determined by the object of taxation. Grants are classified by source of income, and property income is classified by type of income. The complete classification system for budget revenues in international government finance statistics is given in Table. 8.1.

Table 8.1

Classification of income

|

Taxes on income, profits and capital gains |

|

|

Paid by individuals |

|

|

Paid by corporations and other businesses |

|

|

Payroll and labor taxes |

|

|

Property taxes |

|

|

Periodic taxes on real estate |

|

|

Periodic taxes on net worth |

|

|

Inheritance, inheritance and gift taxes |

|

|

Finance and equity taxes |

|

|

Other non-recurring property taxes |

|

|

Other recurring property taxes |

|

|

Taxes on goods and services |

|

|

General taxes on goods and services |

|

|

Value added taxes |

|

|

Sales taxes |

|

|

Turnover taxes and other general taxes on goods and services |

|

|

Profit of fiscal monopolies |

|

|

Taxes on specific services |

|

|

Taxes on the use of goods and on permission to use them or to carry out activities |

|

|

Motor vehicle taxes |

|

|

Other taxes on the use of goods and on the permission to use them or to carry out activities |

|

|

Other taxes on goods and services |

|

|

International trade and transaction taxes |

|

|

Customs and other import duties |

|

|

Export taxes |

|

|

Profits of export or import monopolies |

|

|

Exchange rate gain |

|

|

Foreign exchange taxes |

|

|

Other taxes on international trade and operations |

|

|

Other taxes |

|

|

Only paid by businesses |

|

|

Paid by other businesses other than commercial, or unidentifiable |

|

|

Contributions / deductions for social needs |

|

|

Social security contributions / contributions |

|

|

Employee contributions |

|

|

Employer contributions |

|

|

Contributions from self-employed or unemployed persons |

|

|

Other social contributions / contributions |

|

|

Employee contributions |

|

|

Employer contributions |

|

|

Imputed contributions / contributions |

|

|

From foreign governments |

|

|

Capital |

|

|

From international organizations |

|

|

Capital |

|

|

From other general government units |

|

|

Capital |

|

|

Other income |

|

|

Property income |

|

|

Interest |

|

|

Dividend |

|

|

Deductions from income of quasi-corporations |

|

|

Property income imputed to policyholders |

|

|

Sale of goods and services |

|

|

Sales by market establishments |

|

|

Administrative fees |

|

|

Market sales by non-market establishments |

|

|

Imputed sales of goods and services |

|

|

Fines, penalties and forfeits |

|

|

Voluntary transfers other than grants |

|

|

Capital |

|

|

Other and unidentified income |

Income reflected in accounting on an accrual basis, i.e. when activities, transactions or other events take place that result in claims for taxes or other types of income. The manner in which this general rule is applied to different types of income is indicated in each section of the classification as appropriate.

With the exception of taxes and social contributions / contributions, the amount of revenue to be recorded is the total amount for which the general government unit has an unconditional claim. As stated earlier, when recording taxes and social contributions / contributions, account should be taken of the fact that the recipient government unit is not usually a party to a transaction or other event that creates a liability to pay taxes or contributions. social security contributions. Therefore, many of these transactions and events constantly elude the tax authorities.

In government finance statistics, it is considered that the income of government units is generated only by those taxes and social security contributions that are actually confirmed by tax assessments and tax returns, customs declarations and other similar documents.

Compulsory transfers levied from other sites and earmarked for social security expenditures are taxes and are classified according to the relevant taxation item. In particular, receipts based on net income adjusted for individual deductions from the tax base and benefits are classified as income taxes, even if they are earmarked for social security benefits. Mandatory payments that are levied at a rate determined by earnings, payroll or number of employees, but do not guarantee eligibility for social security benefits, are classified as payroll taxes or labor taxes.

The coverage, timing and valuation of tax revenues in government finance statistics and SNA 93 are identical, but there are differences in classification systems. SNA-93 contains provisions on the compilation of statistics on 1) taxes on production and imports; 2) current taxes on income, property, etc. and 3) taxes on capital. The approach taken in government finance statistics is to classify taxes primarily by the object of taxation. Taxes are grouped into six main categories: 1) taxes on income, profits and capital gains; 2) taxes on payroll and labor; 3) property taxes; 4) taxes on goods and services; 5) taxes on international trade and operations; 6) other taxes.

As a rule, the direction of revenues from a particular tax to the intended use does not affect its classification. An exception is the distinction between payroll and labor taxes and social security contributions / contributions. If the income is intended to be used under a social security program, it is a social security contribution / deduction. Otherwise, they represent a tax on payroll and labor.

Taxes and other compulsory transfers should be recorded when activities, transactions or other events occur that result in government claims for taxes or other payments. This time is not necessarily the time the taxable event occurred. For example, a capital gains tax liability usually arises on the sale of an asset, rather than on an increase in its value.

Tax refunds are generally treated as negative taxes. Refunds are adjustments for amounts overpaid. They refer to the period in which the event that caused the overpayment took place. In the case of a tax (value added tax) taxpayers other than end consumers are generally eligible for a refund of taxes paid on purchases. If this refund exceeds the amount of taxes paid by that taxpayer, the net refund is shown as negative tax.

Tax credits are amounts deducted from tax that would otherwise be payable. Certain types of loans can result in a net payment by the government unit to the taxpayer. Such net payments are recognized as an expense and not as a negative tax.

In some cases, taxes are collected by one government unit, which then transfers part or all of them to another government unit. Depending on the mechanism in place, taxes transferred to a second government unit may be redistributed as part of the tax revenue of that unit, or recorded as tax revenue of the collecting unit and as a grant from this unit to another government unit.

As a rule, the tax is assigned to the state unit, which a) exercises its powers to collect tax (either as a principal or as a result of delegating the powers of the principal to it), b) has the right to independently make the final decision on establishing and changing the tax rate, and c) has the right to independently make the final decision on the use of funds.

Taxes on income, profits and capital gains, as a rule, they are charged 1) from wages, fees, commissions, additional social payments and other types of payment for labor services; 2) from income in the form of interest, dividends, rent and royalties; 3) from capital gains and losses, including the distribution of capital gains of investment funds; 4) from the profits of corporations, partnerships, enterprises without the formation of a legal entity, estate and trusts; 5) from the taxable part of social security, pensions, annuities, life insurance and other retirement accounts; 6) from various other items of income.

Taxes on income, profits and capital gains apply either to individuals or to corporations and other businesses. In the absence of the information required to determine whether taxes should be categorized as specified, those taxes are reported as non-categorized. Income taxes on estate are treated as taxes on individuals. Taxes on income of non-profit units are treated as corporate taxes. Taxes on the income of trusts, if the recipients of the income are individuals, are treated as taxes on individuals, and otherwise as taxes on corporations. These taxes may be levied on actual or estimated income and profits and on realized or unrealized capital gains. The amount of income subject to tax is usually less than gross income, as various deductions are allowed. Income tax is levied on the difference between income and allowable deductions.

Property taxes includes taxes on the use, ownership or transfer of property. These taxes can be levied on a regular basis, as a lump sum, or on a transfer of ownership. Property taxes fall into six categories: recurring taxes on real estate; periodic taxes on net worth; inheritance, inheritance and gift taxes; taxes on financial transactions and capital transactions; other non-recurring property taxes; other recurring property taxes.

Periodic taxes on real estate cover taxes regularly levied on the use or ownership of real estate, including land, buildings and other structures. These taxes can be levied on owners, tenants, or both. These taxes usually amount to a certain percentage of the property's assessed value, which is determined based on notional rental income, selling price, capitalized income, or other characteristics such as size or location. Unlike recurring taxes on net worth, the liabilities on the property are generally not taken into account when calculating these taxes.

Periodic taxes on net worth cover taxes regularly levied on net worth, which is generally defined as the value of a wide range of movable and immovable property less liabilities on that property.

Inheritance, inheritance and gift taxes are treated in the 1993 SNA as taxes on capital. In government finance statistics, they cover death transfer taxes and gift taxes. Taxes on the transfer of property in the event of death include inheritance taxes, which are usually based on total estate, and inheritance taxes, which may be determined by the amount received by the beneficiaries and / or their closeness to the deceased.

Taxes on financial transactions and capital transactions. This item includes taxes on the transfer of ownership, except in cases classified as gift, inheritance or transactions with inherited property. This category includes taxes on the issue, purchase and sale of securities, taxes on checks and other forms of payment, and taxes levied on specific legal transactions such as the approval of contracts and the sale of real estate. This category does not include taxes on the use of goods; capital gains taxes; periodic taxes on the net worth of assets; other non-recurring property taxes; fees paid to cover legal costs, fees for the issuance of certificates of birth, marriage or death; sales taxes and general stamp duties.

Other non-recurring property taxes also classified in the 1993 SNA as taxes on capital. In government finance statistics, this item covers taxes on net worth and property, levied on a lump sum or irregular basis. It includes taxes on net worth, levied to cover contingencies or reallocations of property; property taxes, improvement and reclamation taxes, taking into account the increase in the value of land in connection with the granting of permission by the government to develop land or the creation of additional infrastructure by the government; taxes on revaluation of capital, as well as any other special taxes on certain types of property.

Other recurring property taxes. This category includes all recurring property taxes not included in Categories 1131, 1132 or 1134, such as periodic gross taxes on personal property, jewelry, cattle, other livestock, other specific types of property, and outward signs of property. Taxes on the use of certain types of movable property, such as motor vehicles and firearms, are classified as taxes on the use of goods and on the authorization to use goods or to carry out activities.

Taxes on goods and services covers all types of taxes levied on the production, extraction, sale, transfer, rental or delivery of goods and the provision of services. In addition, it includes taxes on the use of goods and on permission to use them or to carry out activities.

This category does not include taxes on international trade and transactions, but includes taxes levied on the importation of products or on the crossing of a border, unless the corresponding obligation is solely related to the fact that the goods in question have crossed the border, but also applies to domestic goods or transactions.

General product taxes and services include all taxes, excluding customs and other import and export duties, levied on the production, lease, delivery, sale, purchase, or other transfer of ownership of a wide range of goods and the provision of a wide range of services. Such taxes may be levied regardless of whether the goods or services in question were produced domestically or imported, and may be imposed at any stage of production or distribution. This category includes income from adjustments made for these taxes when goods cross the border. Conversely, refunds of such taxes on the export of goods are recorded as negative taxes under this category. When taxes are levied on a limited list rather than a wide range of goods, such taxes are included in the excise category. Decisions on "borderline cases" are made in light of the dominant characteristic of the tax. This article is divided into the following categories.

Value added tax - This is a tax on goods or services, which is gradually collected by enterprises, but in the end is fully collected from end customers. It is called a deductible tax because manufacturers are usually not required to pay the government the full amount of tax that they bill their customers, as they are allowed to deduct from it the amount of tax that was charged when they bought goods or services for intermediate consumption. or the accumulation of fixed capital. VAT is usually calculated based on the price of a product or service, including any other taxes on that product. In addition, VAT may be levied on the import of goods or services in addition to any import duties or other import taxes.

Sales taxes includes all general taxes levied at only one stage - either at the stage of manufacture or production, or at the stage of wholesale or retail trade.

Turnover taxes and other general taxes on goods and services include multistage cumulative taxes, which are imposed every time an operation is performed, without a reduction in the amount of taxes paid for the input resources, as well as all general consumption taxes that combine elements of value added taxes, taxes with sales or multi-step taxes.

Excise taxes are taxes levied on certain types of products or on a limited list of products that cannot be classified as general taxes on goods and services, profits of fiscal monopolies, customs and other import duties or export taxes. Excise taxes can be levied at any stage of production or distribution and are usually based on the value, weight, concentration or quantity of the product. This category includes special taxes on certain products (sugar, beets, matches and chocolate); taxes levied on a certain range of goods at different rates; and taxes imposed on tobacco, alcoholic beverages, motor fuels and hydrocarbon oils. If a tax levied primarily on imported goods under the same law applies (or can be applied) also to comparable domestically produced goods, then the income from it is classified as income derived from excise taxes and not from import duties. This principle applies even in the absence of comparable domestically produced products or in the absence of the ability to produce such products. Electricity, gas, energy and energy taxes are treated as taxes on goods and relate to excise taxes, not taxes on specific services.

Profit of fiscal monopolies includes that part of the profit of fiscal monopolies, which is transferred to the government. Fiscal monopolies are state corporations (organizations) or state quasi-corporations that exercise the tax powers of the state through the use of monopoly rights over production or distribution of a certain type of product or service. Such monopolies are established for the purpose of collecting government revenues that might otherwise be collected through taxes levied on the production or distribution of the goods in question by the private sector. Typical goods subject to fiscal monopolies are tobacco, spirits, salt, matches, petroleum products and agricultural products.

A distinction is drawn between fiscal monopolies and state-owned enterprises, such as enterprises of railway transport, electricity, postal services and other communication services. Such enterprises can enjoy the rights of a monopoly or quasi-monopoly, but they are usually created primarily for the implementation of the tasks of state economic or social policy, and not for the purpose of collecting revenues for government bodies. Transfers from such state-owned enterprises to government are recorded as dividends or deductions from the income of quasi-corporations. The concept of fiscal monopoly does not apply to state lotteries, the profits from which are also considered dividends or deductions from the income of quasi-corporations. The profits of export or import monopolies remitted by sales organizations or other enterprises engaged in international trade are similar to those of fiscal monopolies, but are classified as profits of export or import monopolies.

In principle, only the amount by which the monopoly profit exceeds some conventionally accepted "normal" profit should be reflected as a tax, but it is difficult to estimate this amount, therefore, in practice, the amount of taxes should be considered equal to the amount of profit actually transferred by the fiscal monopolies to the government. This excludes any reserves created by fiscal monopolies. Such taxes are recognized at the time of transfer of funds, and not at the time of receipt of profit.

Taxes on specific services. This category includes all types of taxes that are levied on payments for specific services: taxes on transport fares, on insurance premiums, on banking services, entertainment, restaurants and advertising. In addition, this category includes taxes on gambling and betting on sweepstakes on horse races, football pools, lotteries, etc. Taxes on entry to casinos, horse racing, etc. also classified as selective service taxes. However, if these taxes are part of a general tax on goods and services, the related income is recorded in category 1141. Taxes on income earned by individuals from football pools or other income from gambling are classified as taxes on income, profits and capital gains. ... Profits paid to the government by state lotteries are treated as dividends or deductions from the income of quasi-corporations. Taxes on checks and on the issue, transfer or redemption of securities are classified as finance and equity taxes. Stamp duties that cannot be attributed to taxes on services or other transactions are classified as other taxes. Electricity, gas, energy and energy taxes are included in the excise category.

Taxes on the use of goods and on permission to use them or to carry out activities. One of the regulatory functions of the state is to establish bans on the possession of certain types of goods, their use or the implementation of certain types of activities without special permission in the form of a license or other certificate, for which a certain fee is required. If the issuance of such licenses is practically unrelated to any action on the part of the government and the licenses are issued automatically after the payment of the prescribed amounts, then they are probably nothing more than a means of collecting taxes, although the government may issue some kind of certificate in return. or permission. However, if governments use the issuance of licenses to carry out a specific regulatory function - for example, to test the competence or qualifications of the person concerned, to check the efficiency and safety of the operation of certain equipment, or to carry out some other form of control that they would not otherwise be required to do to implement, then these receipts should be recorded as sales of services and not as tax receipts, unless the receipts are clearly not comparable to the costs of providing those services. In practice, the line between taxes and administrative fees is not always clear-cut.

The following types of levies are considered as taxes: a) levies, the payers of which are not the beneficiaries, for example, levies levied from slaughterhouses to finance services provided to farmers; b) fees under which the state does not provide any specific service in return, even if the payer is issued a license, for example, a license for hunting, fishing or shooting without the right to use a certain area of state land, and c) fees under which the beneficiaries are only payers of these fees, but the benefit to each individual is not necessarily proportional to the payments made, such as a milk marketing fee paid by farmers to promote milk consumption.

Motor vehicle taxes. This category includes taxes on the use of motor vehicles or on permission to use motor vehicles. It does not include taxes on motor vehicles as property or net worth, or charges for the use of roads, bridges and tunnels.

Other taxes on the use of goods and on permission to use them, or on the implementation of activities. This category includes licenses to conduct commercial and professional activities. Such licenses can take the form of taxes on permission to conduct business in general or a specific type of commercial or professional activity. This category includes general taxes or business licenses, which are levied either as a fixed amount, on a fixed scale depending on the specific type of activity, or calculated on the basis of various indicators, for example, size of area, installed horsepower, capital or tonnage of freight vehicles. This category excludes business taxes levied on gross sales, which are classified as general taxes on goods and services. Taxes or licenses for specific business activities include permits to sell goods or provide services. These taxes can be levied on a regular basis, as a lump sum, or every time the goods are used. In addition, this category includes taxes on environmental pollution levied on the release or discharge into the natural environment of poisonous gases, liquids or other harmful substances.

In addition to commercial and professional licenses, this category includes taxes on hunting, shooting or fishing permits and taxes on the ownership of pets where the right to conduct such activities is not granted as part of a normal commercial transaction. This category also includes licenses for radio and television broadcasting, with the exception of cases where government agencies broadcast radio and television to the entire population, and then there is not a tax, but a service fee.

Other taxes on goods and services Includes taxes on the extraction of minerals, fossil fuels and other non-renewable resources from deposits owned or owned by another government, as well as any other taxes on goods or services not included in categories 1141-1145. Taxes on the extraction of non-renewable resources are usually levied as a fixed amount per unit of quantity or weight, but may also be levied as a percentage of the value. These taxes are recorded when resources are mined. Payments for the extraction of non-renewable resources from deposits owned by the recipient government unit are classified as rent.

International trade and transaction taxes includes income from all types of taxes on goods imported into the country, or on services rendered to residents by non-residents. These taxes can be levied for income or protectionist purposes and are determined either on an individual basis or according to the value of the goods (on an ad valorem basis), but by law they should only apply to imported products. This category also includes fees imposed in accordance with the list of customs tariffs and additions to it, including tax surcharges based on the list of tariffs, consular, tonnage, statistical, fiscal charges and tax surcharges that are not based on the list of customs tariffs. Taxes that apply to imported goods only because the latter are included in a broader category of taxable goods are recorded as general goods and services taxes or excise taxes.

Where government or monetary monopoly power is exercised to obtain a margin between the purchase and sale price of foreign exchange, other than to cover administrative costs, the proceeds received represent a mandatory fee levied on both buyer and seller of foreign currency. Such a levy is the common equivalent of import and export duties levied under a single exchange rate system, or a tax on the sale or purchase of foreign exchange. Like the profits of export or import monopolies, these revenues are a mechanism for exercising monopoly rights for tax purposes and are included in tax revenues when received by the government. This category does not include any transfer to the government of exchange gains earned other than by maintaining the difference in exchange rates.

Foreign exchange taxes Includes taxes levied on the sale or purchase of foreign currency at either the same or different exchange rates. This category also includes taxes on transfers of funds abroad, if these taxes are levied on the purchase of the foreign currency transferred. Foreign currency transfer taxes that are not levied on purchases are shown by category other taxes on international trade and operations.

Contributions / deductions for social needs classified as social security contributions / contributions or other social security contributions / contributions, depending on the type of program to which they are enrolled.

Social security contributions / contributions classified according to the source of contributions / deductions. Employee contributions paid directly by employees or deducted from employees' wages and transferred on their behalf by the employer. Employer contributions paid directly by employers on behalf of their employees. Amounts paid by general government employers are not eliminated on consolidation if the payer and recipient units are in the same sector or sub-sector, as these contributions are deemed to be subject to notional reassignment (“rerouting”) and then paid workers. Contributions from self-employed or unemployed persons paid by payers who are not employees. Non-categorized contributions / deductions - these are contributions / deductions for which it is not possible to determine the source of their receipt. If contributions / contributions are made voluntarily, it is useful to present the total as a memo item for calculating the fiscal burden indicator and other purposes.

TO other social contributions / deductions refers to actual and imputed contributions / contributions to social security schemes administered by governments as employers on behalf of their employees, which do not provide retirement benefits. Unlike social security programs, social security programs for government employees tend to link the level of benefits directly to the level of contributions / contributions. Such programs are usually implemented by a government only for its employees, but they can also be implemented by one government on behalf of employees of many government bodies.

Employee contributions includes amounts paid directly by employees or transferred from wages and other forms of remuneration by employers on behalf of employees.

Employer contributions includes amounts paid by employers on behalf of their employees. As with employers' social security contributions, these contributions are not excluded on consolidation if the payer and recipient governments are in the same sector or sub-sector.

Imputed contributions / contributions This occurs when governments, as employers, provide social benefits directly to their employees, former employees, or their dependents from their own resources, without the involvement of an insurance company or autonomous or non-autonomous pension fund. In this case, current workers are considered to be protected from various agreed social risks, even if no payments are made to cover them. The sum of accrued income in this category is the amount of social contributions made by employers that would be required to ensure the actual rights of workers to receive social benefits.

Grants are non-compulsory current or capital transfers received by a government unit from another government unit or from an international organization. Grants are classified first by the type of unit providing the grant and then by whether the grant is current or capital.

In government finance statistics, three sources of grants are distinguished: grants from foreign governments, grants from international organizations, and grants from other units of the general government. The last category, grants from other general government units, is needed only when statistics are compiled for a subsector of the general government sector. Otherwise, these transactions are excluded during consolidation.

The current grants are those grants that are provided for the implementation of running costs and are not associated with the acquisition of any asset by their recipient and are not conditional on such an acquisition. Capital grants provide for the acquisition by the recipient of assets and may consist of a transfer of cash that the recipient is expected or required to use to acquire an asset or assets (other than inventories), transfer an asset (other than inventories and cash), or cancellation of the obligation by mutual agreement between the creditor and the debtor. If in doubt about the nature of a grant, it should be classified as current. The allocation of capital grants is required to calculate gross and net savings.

In addition to taxes, social contributions / contributions and grants, income includes property income, income from the sale of goods and services, and various other types of income, defined in the budget classification of income as other income.

Property income in government finance statistics, includes the different types of income generated by a general government unit when it places its financial and / or non-produced assets at the disposal of other units. Income attributable to this category can take the form of interest, dividends, deductions from quasi-corporation income, property income imputed to policyholders, or annuities.

Interest are receivable by general government units that own certain types of financial assets, namely deposits, securities other than shares, loans and receivables. These types of financial assets are created when a general government unit lends funds to another unit. Interest represents the income received by the creditor for granting permission to the debtor to use his funds. Interest income accrues on a continuous basis over the life of the financial asset. The rate at which the interest is calculated can be set as a percentage of the principal outstanding, as a predetermined amount of cash, or as a combination of the two.