Term asymmetric information used in economics to describe situations in which some of the participants in a business enterprise have important information, while another part of the stakeholders do not. Asymmetric information is typical for many situations in economics: as a rule, sellers of a product know much more about its quality than buyers; workers know about their abilities better than entrepreneurs, and managers know about their abilities better than business owners.

We will begin our consideration of asymmetric information with a situation in which sellers have more accurate information about the quality of a product than buyers, using the example of insurance and credit markets.

PW 1: The operation of the insurance market can be made problematic by adverse selection resulting from asymmetric information. People who buy insurance know much better about their health than insurance companies. Since people suffering from any diseases are more willing to be insured, their share in the total number of insured persons increases. This increases the price of insurance, which leads healthy people, weighing their risk, to choose not to insure. Thus, the proportion of people suffering from any disease increases even more, which again leads to an increase in the price of insurance, etc. until only this category of people remains on the insurance market. Thus, when asymmetric information leads to adverse selection of insureds, insurance companies become unprofitable. Therefore, in many countries, people over 65 years of age face difficulties in obtaining health insurance. Such situations force the state to intervene in health insurance issues, especially for older people, leveling the effects of adverse selection.

PR 2: The asymmetry of information in the credit market is that debtors know better than creditors whether they will repay the debt or not. Companies set the same percentage for all borrowers, which also attracts the category that does not want to pay. This leads to an increase in the interest rate on the loan, which again increases the share of defaulters (payers do not want to pay a high interest rate and do not enter into contracts), the interest rate on the loan increases again, etc. As a result, loans would become very expensive and honest borrowers would not be able to take advantage of them. Therefore, to partially solve the problem of asymmetric information and adverse selection in the credit market, the exchange of information about unscrupulous clients plays a very important role. Without this, the existence of the credit market would be impossible.

An important mechanism to overcome asymmetric information is market signals .

The concept of market signals was first developed by Michael Spence, who showed that in some markets sellers provide buyers with some kind of signals containing information about the quality of the product.

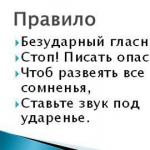

Consider the labor market, which is a good example of a market with asymmetric information: workers know much more about the quality of their work than employers. In order for a signal to be significant, it must be such that it could be used to distinguish a highly skilled worker from a low-skilled one. A significant signal on the labor market is education . Here, the number of years of education, the degree obtained, the reputation of the educational institution that issued the diploma, etc. are of great importance. Firms view education as a signal of productivity. Highly productive workers will want education, even if it doesn't improve their job performance. They will receive it in order to be able to signal the quality of their work (but ultimately, of course, education increases productivity and provides additional knowledge).

Signals can also exist in other markets with asymmetric information: markets for televisions, refrigerators, cars, etc. Firms that produce high-quality, reliable products send signals to consumers using guarantees And guarantees (in the case where consumers cannot determine which brand is better). Long-term obligations are more expensive for the manufacturer of a low-quality product, because it must be repaired more often at the company’s expense, and it can go bankrupt on free repairs. Therefore, guarantees can be assessed as signals of high quality of the product, and consumers will be willing to pay a higher price for such a product.

Conclusion:

Thus, completing the study of the microeconomics course, we analyzed the difficulties that may arise in the market due to the problem of externalities, the need to produce public goods and the asymmetric distribution of information. In this regard, in this lecture we dwelled on the concept of external market effects, explained their occurrence, and found out ways to solve this problem using the example of environmental pollution. We also examined the features inherent in public goods, learned what difficulties arise in the market due to the need for their production, and how the types and volumes of production of public goods are determined in society, i.e., we examined the theory of public choice. In this lecture, we also focused on the concept of asymmetric information and the problems that may arise in the market in connection with this. At the same time, special attention was paid to the uncertainty of the quality of goods.

Information asymmetry (Asymmetric information) is a situation where important information is available to some market participants, but not to other stakeholders.

When analyzing a highly competitive market, an abstract model with all its inherent conventions is usually created. It is assumed that in such a market information is distributed symmetrically, i.e. all participants have equal access to it. There is absolutely no uncertainty, which allows you to use available funds and resources in the most effective way.

Probably the most common way to reduce information asymmetry is market signals, or, in other words, information about an economic good transmitted from seller to buyer. The author of the idea of market signals is the 2001 Nobel Prize winner, American economist Michael Spence.

What is a market signal? The first thing that comes to mind is advertising. But advertising does not reduce asymmetry, since it can apply to both high-quality and low-quality goods. Therefore, sellers need to submit not the usual, but effective market signal, i.e. a signal that is more likely to be given by sellers of goods of high quality rather than of low quality.

Also, the appearance of the product can serve as a market signal - high-quality seams on clothes, good finishing of furniture, aesthetic appearance of food products, etc. – correspond to the higher quality of the product itself; diplomas and certificates in the labor market; seller's reputation, etc.

Michael Spence analyzed such a signal in the labor market as education. How can an employer find out about the quality of the goods he is purchasing, i.e. labor services? How to recognize a more qualified worker among many low-skilled workers? After all, it’s not easy to do this based on the applicant’s appearance during an interview. An expensive suit, a neat appearance, high-quality makeup, well-spoken speech, etc. they don’t say anything about the professional skills of the person who came to get a job. In M. Spence's model, education is an effective market signal. It speaks about the existing abilities of the future employee, since capable people often graduate from universities, institutes, colleges, etc. Thus, when hiring new workers, employers have the opportunity to reduce or avoid asymmetric information that arises in the labor market using such a market signal like education.

Also can be considered as market signals guarantees and obligations. Typically, only those companies that produce high-quality products provide long-term warranties and assume that the provision of such obligations will not become very frequent. On the contrary, companies that produce low-quality goods are not interested in long-term guarantees, which, in this case, will certainly have to be satisfied. Therefore, warranties may be perceived by buyers as signals of high quality of the product and they will be willing to pay more for products sold with warranties.

The combination of the company's guarantees with its positive reputation increases the effectiveness of the market signal. The promise of guarantees by a little-known company does not create confidence in the consumer that he is buying a quality product. It is no coincidence that one of the mottos of Nizhny Novgorod merchants back in pre-revolutionary Russia was the following slogan: “Profit is above all, but honor is above profit.”

Another way to reduce information asymmetry is government intervention.

Add to bookmarks

Add commentsThe presence of accurate information does not guarantee the success of the market, but it greatly facilitates its achievement, helping to increase the efficiency of coordination and the optimal distribution of available resources. However, the reality is far from this ideal picture. We encounter information asymmetry every day when we see people gambling, going shopping in stores or markets, and offering our services. The organizers of the gaming business know much more about its intricacies than ordinary participants; sellers of a product are better informed about its quality than buyers; Insured persons have more information about the objects of insurance than insurance companies. Potential sellers (like potential buyers) often hide the true goals of their behavior and use different goals for their behavior and use various methods to obtain one-sided advantages. The market mechanism fails due to incompleteness (asymmetry) of information.

In economics, asymmetric information occurs when one party to a transaction has more information than the other (the English term asymmetric(al) information; in Russian literature it is also called imperfect information, incomplete information).

There are two types of information asymmetries - hidden characteristics and hidden actions. Hidden characteristics occur when one of the parties to a market transaction has more complete information than the other. Hidden actions occur when a participant in a market transaction with more complete information can take actions that cannot be observed by a less informed participant. To understand the essence of the problem posed, two circumstances should be taken into account.

The first of them is that hidden characteristics are a consequence of the properties of the object of the market transaction itself, that is, goods. There are goods whose quality can be determined at the time of purchase. There are goods whose quality can only be revealed during consumption, that is, after purchase. Products may have hidden defects that will only become apparent during use. But there is a third type of goods, the quality of which cannot be determined even during consumption. Typical examples of such goods include medicines and cosmetics, for which it is difficult to determine the extent to which their actual properties correspond to those declared by the seller. The last two types of goods themselves give rise to information asymmetry. The same can be said about the participants in a market transaction, in which the intentions of the opposing party are always hidden characteristics.

The second circumstance is that the presence of information asymmetry creates the opportunity for its abuse, that is, for dishonest behavior. If the seller knows that the quality of a product cannot be determined even during its consumption, then why would he not sell a lesser quality product at an inflated price? Moreover, for the seller such behavior will be completely rational. The insured may take actions (intentional and unintentional) that, while remaining unobservable to the insurer, will affect the occurrence of the insured event.

The forms in which the influence of information asymmetry on the market manifests itself are diverse.

In some cases, information asymmetry can cause the market power of sellers to develop. Obtaining information involves additional costs for the buyer. When buyers are unaware of the costs associated with searching for information and the benefits of obtaining it, the seller can take advantage of this by setting the price of the product above the equilibrium price. Even in a perfectly competitive market, situations arise where the seller can sell at prices that exceed the marginal cost of production. A typical example is higher prices in places frequented by tourists. Of course, the reason for this is not only information asymmetry. But it plays an important role, since often it is enough to go around the corner to buy the same product at a significantly lower price. But a person who does not have reliable information about the price level will not do this, since he does not know what benefit he will receive. A local resident, knowing the price order, will make a purchasing decision based on the comparison of additional costs (time to walk around the corner) and benefits (difference in price). This may partly explain the fact that the same goods are sold at different prices. The conclusion is that information asymmetry is a factor that reduces the effectiveness of price competition.

Information asymmetry serves as a source of price discrimination. Often the buyer is not able to determine the quality characteristics of the good. This allows the seller to differentiate the product not by actually changing the product parameters, but by simulating them. The same product can be sold in different packages at different prices under different names - in this case we will have a typical example of price discrimination based on information asymmetry.

It is not only the consumer who suffers from information asymmetry. Hidden characteristics of buyers often cause shortfalls in profits, even for firms that have significant market power. For example, a monopoly airline can make maximum profits if it sets prices in accordance with consumer preferences. Entrepreneurs have a higher willingness to pay than tourists. However, the category to which each specific passenger belongs is a hidden characteristic for the carrier, which is the reason for inefficiency. Setting the ticket price at the “entrepreneurial” level gives a high income per ticket, but will reduce total revenue due to a decrease in aircraft load. Setting the ticket price at the “tourist” level will ensure that the plane is fully loaded, but will lead to a decrease in income per ticket. Hidden characteristics pose a major challenge to employers when recruiting labor. If the employer is unable to determine the professional qualities of employees, this may cause not only a reduction in his profits, but also a decrease in the efficiency of the labor market.

The above illustrates that information asymmetry has a significant impact on both the behavior of market participants and the mechanism of its functioning. Depending on the degree of information asymmetry, the negative consequences caused by it can manifest themselves both in the suboptimal distribution of resources and in the impossibility of establishing market equilibrium.

Modern achievements in the development of information and communication technologies lead to the formation of a global information environment for economic activity. Currently, information is considered as one of the main resources for the development of society.

Depending on the types of human activity, information is divided into scientific, technical, production, managerial, economic, social, legal, etc. Each type of information has its own processing technology, semantic load, value, forms of presentation and reflection on physical media, requirements for completeness, accuracy, reliability, and efficiency.

The significance of information for decision making does not require any special justification. Sufficient evidence is that the assumption of completeness of information was accepted as mandatory in the analysis of all major microeconomic market models. Meanwhile, information support is a very complex problem.

For more than two centuries, the assumption of completeness and accuracy of information available to market participants formed the basis of the axiomatics of classical economic theory and neoclassicism. This assumption was based on A. Smith's idea that competitive markets, guided by the "invisible hand", lead to efficient results. However, in the twentieth century. It became increasingly obvious that the assumptions about the completeness of information available to market participants, put forward in the 19th and 20th centuries, did not correspond to reality.

In 1963, Kenneth Arrow, in the article “Uncertainty and Welfare Economics in Health Care,” first noted this property - the property of information asymmetry. The theory of information asymmetry was most fully and comprehensively revealed by George Akerlof in his work “The Market for Lemons: Quality Uncertainty and the Market Mechanism” (1970). This scientist built a mathematical model of a market with imperfect information. He noted that in such a market the average price of a product tends to decline, even for products of ideal quality, and it is even possible that the market will shrink to the point of disappearing completely. In general, the “market for lemons” can be characterized as a market with a high degree of information asymmetry. The essence of the problems of the “market of lemons” comes down to the fact that, firstly, the presence of hidden characteristics creates incentives for dishonest behavior (the risk of irresponsibility) and, secondly, hidden actions trigger a mechanism of market destruction (negative selection).

Consequences of the risk of irresponsibility in a one-time transaction, the mechanism of action of negative selection and its consequences.

Michael Spence also proposed the signaling theory. In situations of information asymmetry, people indicate which type they belong to, thereby reducing the degree of asymmetry. Initially, the job search situation was chosen as a model. The employer is interested in recruiting staff. All applicants naturally claim that they are excellent learners. But only the applicants themselves have information about the actual state of affairs. This is a situation of information asymmetry.

In modern scientific literature, information asymmetry is defined as follows. "Information asymmetry in microeconomics is the uneven distribution of information about a product between the parties to a transaction." Usually the seller knows more about the product than the buyer). In other words, the consumer does not know what exactly he is buying, and the quality of the product is revealed during its operation.

A more complete definition: information asymmetry is “different awareness of market agents about the terms of a transaction and each other’s intentions; it is a manifestation of the uneven distribution of information between market participants - buyers and sellers, investors and investment recipients.”

Asymmetric information covers various areas of activity, each of which has its own characteristics. Information asymmetry is present in all markets, only in some cases its effect is negligible, in others it is very significant.

Information asymmetry occurs because:

The information may not be reliable, and verification may require additional resources. Therefore, any individual does not necessarily strive for super-reliability of information. At the very least, obtaining almost any information is associated with costs. So the desire to obtain it involves balancing the costs associated with obtaining information and the additional benefits from obtaining it.

There is a lot of information, there may not be enough money to collect and accumulate it all, and, in addition, a person may make the wrong decision, he may collect the wrong thing.

Not all objects of market relations are equally capable of selecting, analyzing and accumulating information about everything that they encounter. After all, there are also cognitive limitations in the perception of information, in its correct understanding and evaluation, which is associated with the peculiarities of human thinking.

Firms can only observe prices, but market demand and competitors' output are unknown to them. A price reduction may be perceived by a firm as a consequence of competitors' increased output, when in fact it was caused by a reduction in demand.

Another significant problem is the reliability of information, given its variability and obsolescence. In addition, even incoming information cannot be fully assimilated, and some part of it will inevitably be cut off.

So, information asymmetry in microeconomics is the uneven distribution of information about a product between the parties to a transaction, which means that one of the parties has information advantages. This is due to the development of productive forces, changes in production relations, conditions of social reproduction and social needs. As a result of changes in the external environment, uncertainty in economic processes, risks and asymmetry of information appear.

Another problem that distorts the functioning of the market mechanism is asymmetric information. Asymmetric information in economic literature refers to the uneven distribution of market information among market participants.

Information for producers and consumers is a necessary condition for successful actions in the market. In reality, consumers and producers do not have complete information about the economic characteristics of a particular product that determine their choice. As a rule, some of them know more than others, i.e. We are talking about asymmetric information. At the same time, information asymmetry not only increases transaction costs, but can also lead to overproduction of some goods and underproduction of others.

Asymmetric information is typical for many situations in economic activity. Typically, the seller of a product knows more about its quality than the buyer. Workers know their skills and abilities better than entrepreneurs. And managers know their capabilities better than business owners.

Asymmetric information explains many institutional rules in modern society. This concept helps explain why automobile and appliance companies offer warranties and services on new models; why firms and workers enter into contracts that provide incentives and bonuses; why corporate shareholders need to monitor the behavior of managers.

Asymmetric information leads to market failure in regulating resource allocation. The consequence of asymmetric information is the uncertainty of the quality of the product or the “market for lemons (sour goods).”

The importance of asymmetric information about product quality was first analyzed by D. Akerlof, who studied the used car market. However, this analysis also applies to the insurance, credit, and labor markets.

Due to information asymmetry, low-quality goods drive high-quality goods out of the market.

The problem of asymmetric information can be solved in many ways. So, in the field of credit information, this could be its computerization. Although this raises the issue of trade secrets, the efficiency of the functioning of credit markets is much more important.

Reputation is also a solution to the lemons market. Buyers make purchases in stores, go to a restaurant, and turn to specialists (electricians, home appliance technicians, etc.) with the appropriate reputation.

The next mechanism to overcome information asymmetry is market signals. The concept of signals was developed by M. Spence, who showed that in some markets sellers provide buyers with some kind of signals expressing information about the quality of the product.

In the labor market, such signals include qualifications, gender (men receive higher salaries than women) and even skin color.

When hiring, new employees know much more about the quality of their work (how responsible, disciplined, qualified, etc.) than the company acting as the employer. Identifying an employee’s ability during a probationary period for a company is always associated with ineffective costs. Therefore, it is advisable for a company to know information characterizing the quality of a potential employee before hiring. This information consists of certain signals. For example, an employee’s appearance and clothing are a signal, but an imprecise one. “They greet you based on your clothes...”, but they see you off on a completely different basis. Bad workers sometimes dress well to get a job. Education is a strong signal in the labor market. An individual's level of education can be measured by several indicators: number of years of education, degrees received, reputation of the university that awarded the degree, grade point average, etc. Education is an important signal of a worker's effectiveness because it is easier for a more capable person to achieve a high level of education.

Signals in the lemon market are guarantees and obligations so that consumers can determine what brand of televisions, refrigerators, etc. more reliable. Companies that produce high-quality, reliable products inform consumers about this through guarantees and obligations.

In this theory, dividends are also considered as signals, which serve as evidence (signal) of good prospects for the development of the company. Enterprises, informing the market about the profitability of their activities, pay dividends. Since this is considered good news in the market, the stock price rises. The higher share price compensates the shareholder for additional dividend taxes.

The state can smooth out information asymmetry by monitoring the quality of goods and services, disseminating information that consumers need, preventing the spread of misleading advertising, etc. The state is called upon to protect poorly informed consumers from actions that they would later regret. Modern government agencies generally regulate working conditions, inspect and sort food products, regulate the appearance and safety of consumer products and require that certain products be provided with appropriate labels. Legislation in the field of consumer protection is of great importance. Serious sanctions are being taken against the sale of low-quality goods, provision of false information about the activities of companies, etc. Due to asymmetric information, private insurance companies may refuse to insure certain types of risks, and then the state takes over.

By providing consumers with information about the quality of goods, the degree of risk in the areas of investment and insurance, etc., the state thereby creates a public good (information), which is used free of charge by all economic entities.

So, the mitigation of market failures is largely due to the further development of institutions in the economy and a change in the role of the state in the economy. Asymmetric information, priorities of the public good, the consequences of external effects are largely determined by the psychology of people, the level of their general culture, morality, morality, the overall level of people’s well-being and their living environment, which can be seriously influenced by a modern strong state. This is why it cannot be limited to only minimal functions.

If we turn to the actually existing economies of the countries of the world, new areas of economic life are constantly being discovered where the limitations of the market are manifested, which necessitates wider participation of the state in economic processes. The totality of such areas determines the maximum permissible limits of state intervention in the development economy and hence the identification of the maximum functions of the state.

State regulation complements and corrects the purely market mechanism. However, speaking about government intervention in the economy, we must raise the question of the permissible limits of this intervention. This is extremely important. If the state, even if guided exclusively by good intentions, exceeds this limit, then the market mechanism itself is deformed. In this case, sooner or later we have to talk about denationalization of the economy.