The Russian economy has suffered many shocks over the past decades. That is why citizens are familiar with terms such as inflation, devaluation and redenomination. However, not everyone, due to the lack of economic education, knows and can explain the correct designation of concepts. Perhaps someone does not know about the past crisis, but heard the word denomination from the lips of politicians shouting that this could have a beneficial effect on the development of the country and would significantly affect the increase in the well-being of the population. In any case, it is worth knowing what a denomination is.

Currency denomination

Denomination from the Latin denominátio means "renaming". But today it is interpreted as a change in nominal value monetary unit due to global upheavals in the economy, usually during hyperinflation, when the treasury receives an excess of funds. In this regard, the state has no choice but to remove large banknotes from circulation, as a rule, replacing them with new denominations of small value. Moreover, they are in no hurry to get rid of the excess: old funds are gradually being withdrawn from the system. At this time they have equal value. The result of all this is poor circulation of money in the country.

The meaning of denomination

Speaking in simple language denomination is when zeros are removed from all current banknotes. For example, in 1961, one zero was removed from the banknote, but in 1997, three were removed at once. In addition, prices are being revised, tariffs for services are changing, and a revolution is taking place in the calculation of pensions, salaries and scholarships. In those years, many countries experienced such drastic changes, this also applies to Russia. Since it was brought into default, many residents lost most savings.

I would like to immediately note that denomination can be carried out under normal conditions in the country. In time it can last from several days to several years. The process may take place quietly, but it also happens with loud scandals, and panic among the population. The depressive situation caused by the denomination was noticed under the USSR in 1961. At that time, the ruble exchange had a negative impact due to the difference in prices for imported products. The question immediately arises: what is the denomination of the ruble, stated in simple language? It's the same one replacing old banknotes with new ones.

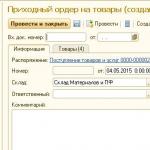

During denomination there is a replacement large bills for small denominations

In the near future, such a measure does not threaten the ruble, because it copes well with the tasks, and cash flows seem to be stable.

Denomination is more beneficial to the state, since with its help it solves several problems in one fell swoop:

- improves the payment system;

- reveals hidden income, this happens when the population has no choice but to take out savings and exchange it;

- emission costs are decreasing;

- increases consumer demand;

- strengthens the national currency.

Read also: FSS: what is it, decoding

What is needed to conduct a denomination?

When the government decides to start redenomination, then within a specified period of time new bills are thrown onto the market and old ones are forced out. As mentioned above, the process can go quickly, or it can take a while. long term. During this time, the entire population should hurry to exchange cash. Amounts stored in accounts are recalculated automatically. Although this process is carried out quickly, the population still endures it with difficulty. It is for this reason that the process takes a long time. “Denomination”, you already understand what this means, now let’s look at the procedure for carrying out the process itself.

The denomination of the ruble will remind the population of life under the USSR

To carry out a denomination, two important conditions must be met:

- There shouldn't be a crisis. There should be a calm in the country.

- Hyperinflation must happen. So that there was a lot of money, and it caused inconvenience.

Only under these conditions can a successful denomination take place. Otherwise, it may have a bad impact on the psychology of citizens and the entire economy as a whole. The fact is that this process puts psychological pressure on the population: they begin to worry about the future, they are worried that the savings will burn out, and therefore they rush to spend them on various purchases. In turn, such an onslaught of consumer demand affects the increase in prices, which only increases inflation, which is directly reflected in the devaluation of the national currency.

A denomination carried out taking into account all economic laws does not harm the country's economy. But when denomination is carried out illiterately or along with inflation, then in practice a completely different picture is obtained, leading to the opposite consequences.

Denomination (from the Latin denominátio - “renaming”) is a monetary reform aimed at reducing the face value (face value) of banknotes in order to stabilize the currency and simplify payments. This is done by gradually withdrawing old banknotes from circulation and replacing them with new ones, with a lower denomination, but the same value.

In simple terms, denomination is when zeros are removed from all current banknotes. For example, in 1961 one zero was removed from the banknote, but in 1997 three were removed. If you received 600,000 a month, then after the reform your salary will be 60 thousand. But you will also buy bread not for 350, but for 35 “new” rubles per loaf.

The main reason for the redenomination is the previous hyperinflation, during which the state currency significantly loses its value. As a result, it turns out that all calculations begin to be carried out in huge multi-digit amounts, a large increase in the money supply occurs, and new banknotes of ever larger denominations have to be constantly issued, which is very inconvenient. To eliminate these problems, money denomination is carried out.

Denomination is usually a consequence of a powerful financial crisis, which causes such a strong acceleration. However, there is no point in launching the denomination process at the peak of the crisis and hyperinflation. We need to wait for the economic situation to stabilize and inflation to decline.

Key goals of the denomination

It is believed that denomination makes it possible to:

- Simplify calculations. This is the main goal of any denomination, because paying with amounts with several zeros is very inconvenient.

- Reduce government spending on emissions. The higher the denomination of money, the more of it is needed, and this applies to both large bills and small change. Due to the need to print more money emission costs are rising. Currency reform helps solve this problem.

- Reveal hidden income. Everything is simple here: the risk of losing savings “hidden under the mattress” forces citizens to exchange savings for new money.

- Strengthen the national currency. This becomes possible because, as a result of denomination, the national currency becomes more “backed” with assets, and excess money supply is withdrawn from circulation, which helps to cope with inflation.

However, the goals of monetary reform outlined above are how it should be. In practice, the consequences of denomination can be negative, especially if it is carried out illiterately or untimely (for example, at the peak of inflation).

In addition, denomination is always a great stress for citizens. Usually they feel afraid of such processes and suspect that it will turn out to be something bad for them, for example, the depreciation of their savings. Therefore, people rush to save their money, for example, by investing it in goods. Due to an increase in consumer demand, prices rise, as a result, inflationary processes intensify, which leads to the depreciation of the national currency.

If economic laws and norms are observed during monetary reform, then it helps to stabilize the economic situation in the country.

Examples of denomination in different countries of the world

Monetary reforms were carried out even in countries that are considered economically developed today. The most interesting examples of denomination can be considered:

- in Germany in 1923, Reichsmarks were exchanged for new marks with a ratio of 1,012:1;

- in Israel in 1985-86, old shekels were exchanged for new ones at a rate of 1,000:1; before this, Israeli liras were exchanged for shekels 10:1;

- in Poland in 1985, old zlotys were exchanged for new ones at a rate of 10,000:1;

- in Turkey in 1995, old liras were exchanged for new ones at a rate of 106:1;

- Zimbabwe implemented monetary reforms in 2006 (1,000:1), 2008 (1,010:1) and 2009 (1,012:1);

- in Ukraine in 1996, karbovanets were replaced by hryvnias in a ratio of 100,000:1;

- denomination in Belarus has been carried out since 2016, old Belarusian rubles are exchanged for new ones at the rate of 10,000:1. That is, as a result, 100 rubles (the lowest denomination) will be replaced by coins of 1 kopeck.

How was money denomination carried out in Russia?

As a result of the revolution of 1917 and civil war, the country's economy suffered greatly. Due to the catastrophic depreciation of money, the state had to begin a monetary reform, as a result of which sovznak were abolished. During the first denomination of 1921, the royal banknotes, nickels, kerenoks and others were exchanged valuable papers for new money at the rate of 10,000:1.

In the spring of 1922, the Soviet government set out to create a stable currency. When choosing a name for it, Narkomfin considered several options: ruble, federal, hryvnia. But they chose the chervonets, in the hope that people would trust a currency with a familiar name more. First, banknotes in denominations of 5 and 10 chervonets were issued, then 1, 3 and 25 chervonets.

Having decided not to delay the second denomination, they soon issued a new ruble, which was equal to 100 rubles of 1922 or 1 million rubles of an earlier issue. The goal of both monetary reforms was to strengthen the Soviet currency. The year 1924 was marked by the release of the first gold chervonets, as well as silver and copper coins - from 5 kopecks to 1 ruble. That is, in the country there was a simultaneous circulation of two currencies at once, the chervonets and the sovznak, which gradually depreciated.

In August 1924, the 1923 banknotes were withdrawn from circulation. As a result, the first Soviet ruble appeared, which was equal to 50 billion rubles in 1922.

Denominations and abolition of the card system

Another important money reform that took place in the Soviet Union in December 1947 deserves attention. Although rumors about these plans reached citizens in advance, so they hastily withdrew money from savings accounts and bought jewelry, watches, furniture and other goods, trying to protect themselves from the depreciation of rubles.

Their fears were not in vain. The exchange of old money for new ones was carried out under the following conditions:

- deposits up to 3 thousand rubles were exchanged 1:1,

- amounts from 3 to 10 thousand rubles were exchanged 3:2,

- and savings over 10 thousand were exchanged at a rate of 3:1.

Those who suffered the most were citizens who kept their money “under the mattress”: one new ruble cost them ten old ones.

The monetary reform was carried out in parallel with the abolition of the card system. In trade, uniform prices and “standards for the sale of food and industrial goods in one hand” were introduced. For example, at one time a person could buy 2 kg of bread, 1 kg of meat, 0.5 kg of sugar and 1 liter of milk. Severe punishment was provided for speculators. Thus, for resale of goods, a person could be imprisoned for up to two years with confiscation of property.

The 1961 denomination was one of the most successful and painless for the population. The economy grew rapidly in the 1950s; cash flow increased. As a consequence, in the early 1960s it was decided to replace the current currency at a rate of 10:1.

For this purpose, about 29 thousand exchange offices were opened on the territory of the USSR. The reform, begun in January 1961, was almost fully implemented by early February, as about 90% of all cash was exchanged. At the same time, the cost of metal coins in denominations 1, 2 and 3 remained the same, which was very profitable for their owners.

New banknotes in denominations of 1, 3, 5, 10, 25, 50 and 100 rubles appeared in circulation. They were smaller in size than the previous ones. This was the most durable Soviet money, existing without exchange for almost 30 years.

"Pavlovsk reform" and its consequences

The last, and perhaps the most dramatic, Soviet monetary reform was implemented in January 1991. It was called “Pavlovskaya”, as it was proposed by the then Minister of Finance Valentin Pavlov. According to the authorities, the purpose of the reform was to protect the financial system from counterfeit rubles that were imported from abroad. In fact, the government wanted to remove the excess money supply from circulation in this way. To achieve this, it was decided to withdraw 50- and 100-ruble banknotes of the 1961 model from circulation. Moreover, the impending changes were announced to citizens in the evening, when the working day in financial institutions was over.

The drama of the situation was that they gave only three days for the exchange. In addition, it was allowed to exchange no more than 1 thousand rubles in cash, and a depositor could withdraw no more than 500 rubles from his account per month. As a result, many citizens lost their savings.

As a result of the reform, 14 billion rubles were confiscated from the population. But this did not help the government stabilize the economy. Prices increased 2–4 times, the standard of living in the country fell. By the end of 1991, the country's economic situation was catastrophic.

To slow down the growth of inflation, the government decided in 1993 to confiscate funds from the population again. In less than two weeks, Soviet money was exchanged for Russian. Now the banknotes were decorated not with a portrait of Lenin and the Soviet coat of arms, but with the towers of the Moscow Kremlin. But this reform was carried out without denomination. The leadership of the Russian Federation understood that the former union republics, which were now independent countries, had printing presses for the production of old-style money, so there was no way to control their release. In addition, these countries began to issue national currencies, and the old money supply, pouring into Russia, could depreciate the money.

Currency reform 1998-2002

Rumors about the upcoming new monetary reform of 1998 began to circulate long before it was carried out. The government decided to take into account the experience of previous years and carry out the redenomination smoothly so that people do not lose their savings, as in 1991. Therefore, the reform dragged on for several years and was completed only in 2002.

On January 1, 1998, banknotes in denominations of 5, 10, 50, 100 and 500 rubles, as well as coins of 1, 2, 5 rubles and 1, 5, 10, 50 kopecks, were introduced into circulation. Moreover, one new ruble was equal to 1 thousand old ones. Old banknotes were removed from circulation without any special procedures, through ordinary methods of money circulation (for example, through trade). The reform was successful. Its result was the introduction of new banknotes into circulation. In the early 2000s, a banknote worth 1 thousand rubles appeared; in 2010 – worth 5 thousand rubles. Well, in 2018 - 200 and 2000 rubles.

Reading time: 8 minutes. Views 12 Published 05/07/2018

Every year in Russia there is a renewed wave of rumors about the redenomination of the ruble. Approximately half of citizens believe that in difficult economic times it is beneficial to receive credits and loans in the form of national currency. Other people are closely monitoring the economic situation, trying to make a forecast for the coming years. How does the denomination affect the country's economy? In this article, we propose to examine the question of what ruble denomination is in simple language.

Redenomination is a decrease in the value of a nominal currency after hyperinflation.

Reasons for the need for denomination

The term in question is closely related to such a concept as inflation. The term “inflation” should be understood as a rise in prices, which is caused by an increase in consumer demand for commodity products. This means that consumer demand is significantly higher than producers' supply.

Inflation is typical for each country and reflects the current state of affairs of the economy.

In the case when production capacity unable to meet consumer demand, costs increase commercial products. The rise in prices is explained by the need to cover production costs. Experts say the “optimal” inflation rate is around five percent. In practice, this indicator is quite rare. There is a need for financial reforms in a situation where the inflation rate is more than twenty percent.

It is important to pay attention to the fact that each country has a certain “limiter” that controls the amount of financial resources. An increase in the cost of marketable products leads to a shortage of national currency. This means that the total value of marketable products is significantly higher than the volume of currency available in the state. In this situation, there is a need to prepare additional financial resources.

Each world currency is backed by gold reserves held by the state. This means that an increase in the volume of production of the national currency leads to a decrease in the value of the monetary units themselves. Constant growth prices requires the issue of monetary units with a high denomination. This means that the number of zeros on the bill increases. In certain economic conditions, each state is faced with the need to carry out financial reform in order to increase the value of the national currency.

There are many various types financial reforms aimed at strengthening the national currency, among them the following should be highlighted:

- release of new monetary units;

- changes in the financial system;

- change in gold equivalent paper money;

- change in the currency itself.

Denomination is closely related to the state's monetary reforms

Denomination is closely related to the state's monetary reforms Types of financial reforms

The main types of financial reforms are revaluation (restoration), nullification, denomination and devaluation. Nullification, as a rule, is carried out with a complete change in the leadership of the state. This process is a procedure during which depreciated monetary units are replaced by new currency.

Next, we propose to consider the process of devaluation. This phenomenon can be characterized as a decrease in the value of a financial unit. The depreciation of money is carried out by reducing the gold equivalent. Thanks to devaluation, the state has the opportunity to increase the cost of export products. But at the same time, the cost of goods coming from foreign countries. The term “devaluation” is used to compare the degree to which a national currency has become cheaper in relation to a foreign currency.

According to experts, the process of revaluation (restoration) is the antonym of devaluation. With the help of this financial reform, the value of the national currency is increased. To carry out revaluation, the state needs to increase the amount of gold used as an equivalent to monetary units. This process is one of the rarest that is used to strengthen the country’s economy.

The process of denomination of financial assets involves changes in the nominal price of monetary units. This means that during this process the price of the national currency decreases in relation to world currencies. According to historians, this process was carried out in every modern country. It is important to note that thanks to denomination, the process of paying for goods is simplified. Denomination is in simple words the process of removing zeros in monetary units. This means that a 10,000 bill turns into 1,000 or 100. These actions are aimed at reducing the volume of funds and simplifying the system of payment for commercial products and services.

In some cases, the term denomination is used as a definition for financial reforms that combine revaluation, nullification, and devaluation.

During the denomination process, banknotes are updated with new ones with a lower nominal value

During the denomination process, banknotes are updated with new ones with a lower nominal value Denomination on the territory of Russia and the USSR

According to historical reports, on the territory of Russia financial reforms were carried out four times. The first denomination was carried out shortly after the end of World War II. The second denomination occurred in nineteen sixty-one. The third financial reform was carried out in nineteen ninety-one, after the “collapse” of the USSR. Many people are interested in the question, in what year was the ruble redenomination in Russia? This financial reform was last carried out in nineteen ninety-eight.

Ten years ago, the first wave of rumors about new financial reforms appeared. It is important to note that these actions are carried out only in the event of a financial crisis. To initiate the procedure, a Presidential Decree is required. Also, many people are interested in the question of whether the ruble denomination has its own specific differences from the financial reforms of other countries. According to experts, many people during the denomination episodes were able to purchase real estate and pay off accounts payable thanks to this procedure. It is quite difficult to make an unambiguous conclusion about whether denomination has a negative or positive effect on the economy, since many different factors must be taken into account.

According to experts, for Russian market A denomination in which the ruble reduces its face value by a thousand times is more appropriate. Carrying out this procedure causes the national currency to become “weightier”. Reducing the denomination of monetary units by less than a thousand times may not give the desired effect. A reduction of ten thousand times could lead to the ruble becoming comparable to the national currency of England, which is rightfully considered one of the heaviest currencies. Reducing zeros can lead to rounding of prices, which will affect the cost of commercial products and services, since the cost of monetary units itself will increase.

The process under consideration is one of the most profitable economic reforms for each country. Even taking into account the fact that preparation for the issuance of new monetary units will require large-scale capital investments, the state has a chance to use modern methods their protection from the production of counterfeits. It should be noted that this process can take a long time, during which both the new and the old currency will be valid. In this situation, banking organizations are one of the direct participants in financial turnover.

In order to stabilize financial system, the state is about to issue new money, and the attachment of paper money to precious metal

In order to stabilize financial system, the state is about to issue new money, and the attachment of paper money to precious metal Expert forecast

No denomination is expected in Russia for the next few years. According to experts, today's denomination of monetary units does not contain “extra zeros” that would need to be removed. Even in times of crisis and when the economy is unstable, the state has other types of monetary reforms, the implementation of which makes it possible to strengthen the national currency.

It also needs to be said that the type of financial reform under consideration contributes to increased inflation. In addition, it should be taken into account that the issue of new banknotes requires substantial investment from the state treasury. Many people are firmly convinced that this reform is beneficial for ordinary citizens. However, this opinion is wrong. A decrease in prices by several tens of times will directly affect the level of income, which will also change downward.

The denomination is preceded by a series of creation of certain economic conditions. These conditions include an increase in production volumes aimed at meeting consumer demand. These actions are necessary to prevent possible shortages of goods on the market. One of the prerequisites for denomination is a situation in which the state does not need to increase the volume of financial resources used in domestic circulation.

The denomination procedure, as a rule, comes after a major crisis in the state

The denomination procedure, as a rule, comes after a major crisis in the state Possible consequences

It is important to pay attention to the fact that all financial reforms carried out by the state affect the country’s economy. Initiation of the procedure in question has the following consequences:

- An increase in the volume of exported goods in order to obtain more national currency.

- Increase in the cost of imported goods.

- The emergence of various difficulties associated with storing funds in national currency. These difficulties apply to both bank deposits and money kept at home.

- The emergence of difficulties with the acquisition of foreign technology and production equipment.

- Increase in the cost of loans received in foreign currency.

The term “denomination” is used not only in the field of economics. This word has several meanings, and some of them have direct relation to religion. One of the meanings of the term “denomination” is the peculiarity of belief in the relations of a particular religion. Also, the term “denomination” is used to designate a religious community, which represents an “intermediate link” between a church and a sect.

In contact with

Many people ask when the ruble will be redenominated in Russia. However, it is not at all easy to answer. Denomination is a phenomenon in economics in which extra zeros are removed from banknotes and on price tags in stores. In contrast, it does not depreciate. The word "denomination" is translated from Greek as "renaming." In this process, bills of the same value are assigned lower values, which greatly simplifies monetary calculations. The article gives an approximate answer to the question of when the ruble will be redenominated in Russia.

Ruble denomination in 1998

A striking example The denomination of the national currency is the denomination of the ruble in 1998. The reasons why this was done were as follows:

- Very high rates of inflation, so-called hyperinflation. In this process, money quickly depreciates, which forces people to switch to higher denomination notes. In the 90s, inflation was catastrophic.

- Financial crisis of 1998. It was the last severe crisis of the 90s, after which a gradual economic recovery began.

- The economic situation in the country begins to improve.

The last point is important because redenomination should be carried out only when the economy begins to improve, otherwise it may lead to a worsening situation.

During the 1998 redenomination, notes with six-digit values were replaced with normal denominations.

Thus, the year of ruble denomination in Russia is 1998.

Why is currency denomination carried out?

The denomination of the ruble in Russia is associated with several reasons. The main goal is to curb inflation, as well as eliminate its consequences. Normal inflation rarely necessitates a redenomination, but when it is too rapid, a redenomination may be necessary. At the same time, the consequences of inflation can be largely neutralized. To achieve such results, you need a competent and thoughtful approach.

Another important goal is to simplify cash payments. In the 90s you had to pay with banknotes a large number zeros, and this, of course, made life difficult for both sellers and buyers. Simply put, it was completely inconvenient. Especially when it comes to buying expensive things.

The third goal is to optimize the amount of money produced. With hyperinflation, there is an increase in the money supply associated with an increase in the size and number of banknotes. As a result, it takes a significant amount of money to issue more funds. And carrying out a denomination optimizes such expenses.

Another goal is to identify hidden cash income and general monetary status in rubles. When exchanging old banknotes for new ones, it will be clear how much ruble money a person had.

Thus, given a certain state of the economy, carrying out monetary reform in Russia (denomination of the ruble) is necessary procedure.

Psychological aspect

Some people may experience tension associated with the subjective feeling of a decrease in personal income. Therefore, when carrying out a denomination, it is important to correctly inform citizens about the absence negative consequences for their personal well-being.

What needs to be done when denominating?

If the decree on this procedure has already been signed, then you need to collect all your ruble savings and visit a special point for exchanging old currency for new. There is no need to be afraid of not having time and being left with nothing. After all, quite a lot of time is allocated to the denomination process. Thus, during the 1998 denomination, exchange offices operated until 2002.

As for bank accounts and electronic money, they will be changed automatically.

Will there be a redenomination of the ruble in Russia?

Rumors about the imminent redenomination of the ruble leak from time to time. However, this information is not true. No bills are being prepared in this regard. The country is in a state of recession, and the authorities have so far refrained from making any radical decisions. The massive transition to electronic currency is also a hindrance.

As for paper money, one cannot help but note the fact that they have greatly depreciated in last years. Just a few years ago, a banknote with a face value of 1000 rubles could provide a fairly large number of small purchases. Now you can buy very little with it. Everyone is increasingly expending money. But the situation has not yet reached a critical level, as it was in the 90s. This means that no special monetary reform will be required.

There will be no denomination of the ruble in Russia for the following reason: large quantity various banks. With such a number, it will be difficult for the state to monitor the implementation of the decree on currency denomination. Observed in Lately reducing the number of banking institutions can improve state control over them and speed up redenomination if the need arises.

The decline in inflation rates to low levels in recent years may be a reason to postpone the decision on currency reform. However, no one can guarantee that prices will continue to be stable, given the large dependence of the Russian economy on world prices for raw materials. If the inflation rate is above 10% per year, then the state may decide to carry out a redenomination. Now it is about 4% per year, and oil prices are quite stable. In connection with all this, the likelihood of a denomination in the coming years is extremely small.

Should we expect a redenomination of the ruble in 2019?

Many people are interested in the question of in what year the ruble will be redenominated in Russia. Unfortunately, even economists don’t know the answer. Regarding 2019, we can say more definitely. The likelihood of a ruble denomination in 2019 is, of course, very low. The magnitude of the risk can be influenced by various factors, but so far they remain relatively stable.

- Fundamental factors. The main thing for our country’s economy now is the stability of oil and gas prices, due to high demand for raw materials in Asia and declining prospects for increasing shale production in the United States. Oil will remain in demand on world markets in the coming years, and therefore no disasters will obviously occur in the Russian economy. Currently, the price of a barrel fluctuates around $75, and in all likelihood, it will remain high in 2019.

- Dollar exchange rate. It has grown noticeably in recent months, which is largely due to US sanctions, but so far the situation is far from critical. The US's ability to impose sanctions against Russia is quite limited.

- Geopolitical situation. Here, too, everything is quite stable so far. Relations with the EU are improving, trade ties with China are increasing. The situation in Ukraine is no longer as acute as it was 3-4 years ago.

- Possibility of restoring economic growth. A change in economic policy could improve the state of the Russian economy. It is likely that such measures will be gradually adopted by the Russian authorities. The main step could be to move away from focusing on the export of raw materials and increase the share of processing industries. Otherwise there will always be risks. The more stable the economy is, the lower the likelihood of hyperinflation and subsequent redenomination of the ruble.

When will the ruble be redenominated in Russia?

It’s really not worth waiting for the ruble to be redenominated in the next 2 years. However, expert opinions on the longer term are no longer so definite. The main threat to the Russian economy after 2020 will be its high dependence on raw materials. Now our country is benefiting because it has reserves of precisely those resources that are most in demand in the world. However, the range of resources in demand may change in the future.

Now the main source of foreign currency inflow to our country is the export of oil, gas and petroleum products. And if everything is in order with our natural gas reserves, then oil resources are quickly depleted. After 2020, the cost of crude oil production may increase, and its volume will begin to decline. As a result, the net profit from the export of this type of hydrocarbons will decrease.

The revolution in renewable energy sources and alternative modes of transport, which began in recent years, could bring oil and coal prices down to $10 per barrel. This is the opinion of the French oil company Engie. History shows that technological revolutions can occur at high speed, many times faster than previously predicted. It is no coincidence that the world's largest oil companies are already planning to adapt to future changes. The Russians are not yet ready for this at all.

The decline in global gas consumption poses less of a threat to Russia, as global demand forecasts are more favorable there.

Declining dollar revenues will contribute to the development of the budget deficit. The gradual depletion of reserve funds will increase the burden on the ruble and lead to a rise in the price of the dollar and euro. All this could cause a new surge in inflation, which means the risk of ruble denomination will increase.

Geopolitical risks

After the end of Donald Trump's presidency, the European Union may once again turn away from Russia and unite with the United States. Such a scenario could lead to the introduction of new collective sanctions and a subsequent weakening of the ruble. Such a situation will cause a new round of inflation and increase the risk of redenomination of the Russian currency.

Recovery of the Russian economy

To minimize all these risks, it is necessary now to move away from dependence on raw materials and reduce dependence on imported equipment. According to experts, the measures currently taken are not enough to achieve such goals. Oil and gas revenues still dominate, and the share of imports of foreign products is very large. The problem of overcoming technological backwardness also remains unresolved.

Conclusion

Thus, to the question of when the ruble will be redenominated in Russia, we tried to give the most complete answer. The most important conclusion is that there is no point in expecting a redenomination of the ruble in the coming years, but it is possible in the more distant future unless a radical change in the economic course is made. As for the date of redenomination of the ruble in Russia, no one knows it now.

From time to time you can hear rumors among people about a possible denomination. At the same time, some believe that during this period it is profitable to take loans in national currency, others watch the economy with fear, not rejoicing in the future. So, is denomination good or bad? What processes in the economy can we talk about if the need for denomination arises?

Where does denomination come from?

Denomination is inextricably linked with the concept of inflation. The latter is typical for every state to one degree or another. The lower the inflation rate, the more reasonably we can talk about the stability of the state’s economic system.

Inflation is an increase in the price level caused by the excess of demand for a product over supply. Insufficient production volumes necessitate higher prices for goods to cover production costs. The ideal inflation rate is considered to be 3-5%, but such figures are not often encountered. With a price increase of 20%, there is a need for monetary reforms.

Currency reforms

Each country has a certain amount of funds. When prices rise, there is a shortage of national currency, that is, the total volume of prices exceeds the volume of currency, which necessitates its additional issue.

Since each monetary unit is backed by gold, the additional issue of monetary units causes their depreciation.

In connection with the increase in prices, banknotes with a higher denomination are issued, that is, in simple terms, an increase in the digit of the banknote, or the addition of zeros. Over time, there is a need to carry out monetary reforms designed to increase the value of the country's currency.

In order to strengthen the monetary system, they resort to changing the national currency, the gold equivalent of paper money, the monetary system, and issuing new money.

Reforms include nullification, restoration, devaluation and redenomination.

Read more about monetary reforms

Nullification is the procedure of replacing a depreciated monetary currency with a new one. Often this reform is carried out when the country's leadership changes.

The economy can also experience revaluation, or restoration, which means the reverse process of devaluation. Revaluation allows you to increase the value of a country's monetary units by backing the currency with more gold. The phenomenon of revaluation is more rare than other methods of stabilizing the economy.

The concepts of devaluation and redenomination are more understandable to the population due to their more frequent occurrence. Devaluation and redenomination - what is it?

Devaluation and redenomination

Devaluation involves the process of cheapening a monetary unit, that is, reducing the gold equivalent of a banknote. This causes an increase in the export price of goods, but at the same time it also increases the prices of foreign goods. Also, when talking about devaluation, they say that the national currency has become cheaper compared to the foreign currency.

Currency denomination is a change in the nominal value of banknotes (reduction), which occurs in a certain ratio. In the history of almost every state there has been a denomination, and often more than one. Thanks to this process, payments for goods become more convenient. How to answer the question: “Denomination - what is it?” in simple words? This is a reduction of zeros in the denomination of banknotes. So, 100,000 becomes 10,000, 1,000, etc. This reduces the volume of banknotes in the country, which simplifies the system of payments for goods and services.

Some sources report that denomination is a monetary reform, the types of which are all three listed above.

Ruble denomination

In the history of Russia (USSR) there were 4 instances of denomination: in 1947, 1961, 1991 and 1997-1998. In 2007-2008, there were rumors about a possible denomination, but it never happened. In the Russian Federation, denomination is usually carried out after a period of crisis and occurs by Decree of the President of the Russian Federation.

So, ruble denomination - what is it and does it have its own characteristics compared to other countries? Remembering previous episodes of denomination, people say that thanks to it, at one time it was possible to pay off the cost of real estate or repay a loan in a short period of time. So is denomination bad in the Russian economy or not?

The most appropriate in the conditions of the Russian economy is to reduce the denomination of the ruble by 1000 times. Denomination is a procedure that makes the national currency heavier. Thus, if the denomination of banknotes is reduced to less than 1,000, the denomination will be less effective, and with a denomination of 10,000, the ruble would be comparable in weight to the British pound, which is considered a fairly heavy currency. In this case, by reducing the zeros, prices would be rounded, which would increase the cost of goods, given the increase in the value of money itself.

Denomination, in principle, is beneficial for the state. Despite the fact that issuing new money is a significant expense for the state, it allows them to develop new degrees of protection. This protects banknotes from counterfeiting.

When exchanging old banknotes for new ones, both those and other money remain valid. In this case, the exchange can occur both when contacting a bank, and directly during payments in stores, at the discretion of the country’s leadership.

Forecasts for denomination in Russia

Today, holding a denomination in Russia is unlikely. As analysts say, banknotes today do not have an extra number of zeros, which would necessitate this. Even in a crisis today, it is more appropriate for the Russian economy to use other methods of stabilizing the monetary unit.

In addition, redenomination is a monetary reform, which usually causes an increase in the level of inflation, and significant funds are needed to carry out redenomination, so the country’s leadership will not agree to this.

There is also no need to talk about the benefits of denomination for the population, because when denomination is carried out, both prices decrease, for example, by 100 times, and income decreases.

There are conditions under which there are prerequisites for the successful implementation of a denomination. These include the presence of production growth, that is, providing the state with the necessary volume of a particular product in order to prevent a supply shortage. Positive prerequisites also include the absence of the need to issue money, that is, additional issue of banknotes, as well as the presence of a gold and foreign exchange reserve that provides support for the national currency. In each specific case, the purpose of the upcoming reform matters.

Consequences of denomination

Such a monetary reform cannot occur without consequences for the economy.

These consequences are:

- Increase in export volume, which allows you to get more national currency or goods per unit of foreign currency.

- Rising prices for foreign goods, That is reverse side export growth.

- The emergence of difficulty in storing savings in national currency due to their withdrawal from circulation. This applies to both money stored at home and savings in the bank.

- Problems arising with the import of equipment.

- Increase in the cost of loans in foreign currency(it can grow several times).

Denomination and religion

Denomination is not only an enlargement of a banknote, but also a specific term related to religion. Denomination in religion is a concept that has several meanings. In the first meaning, it is synonymous with the concept of “confession,” which is clear to the majority (a feature of religion within a certain religious teaching).

According to the second meaning, it is a religious community that has an intermediate position between a sect and a church.

Previously, a denomination was a name for religious movements that were just beginning to develop (the term appeared in the era of the Reformation).

Features of a religious denomination

Speaking about a denomination in the context of an association that combines the features of a church and a sect, it is necessary to have an idea of what exactly the denomination borrowed from both.

A sect usually recognizes only the faith that it professes, denying all others. The denomination is religiously tolerant, recognizing other religions and beliefs, which unites it with the church. In addition, the denomination borrowed hierarchy and its open type in relation to the surrounding world. It recognizes the possibility of soul salvation if a person has sufficient faith.

At the same time, this confession has existed for a relatively short time, just like sects. She is also connected with the sect by active religious activity, opposing herself to the church.

In the structure of a religious denomination, a vertical system of subordination and a horizontal system of distribution of responsibilities are distinguished.

There is some inconsistency in the fact that the denomination recognizes the equality of all its members, and at the same time, within it there is a division into the elite and ordinary members of the community. The elite has broad powers and opportunities.